Quantum Computer Stocks Crash After Jensen Huang's Remarks

Jensen Huang’s comments on quantum computing timelines trigger a major stock crash, revealing the challenges and potential awaiting this revolutionary technology.

Key Points

- Jensen Huang

's prediction that quantum computers are 20 years away from practical use led to significant declines in stock prices for major quantum computing companies.

- Despite the stock downturn, some industry leaders challenge Huang's views, asserting that quantum technology is already operational with commercial applications.

- The mixed market response highlights the volatility of quantum computing investments and the long-term challenges the sector faces before realizing its full potential.

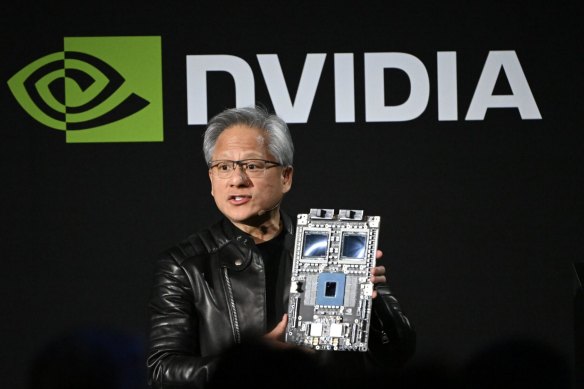

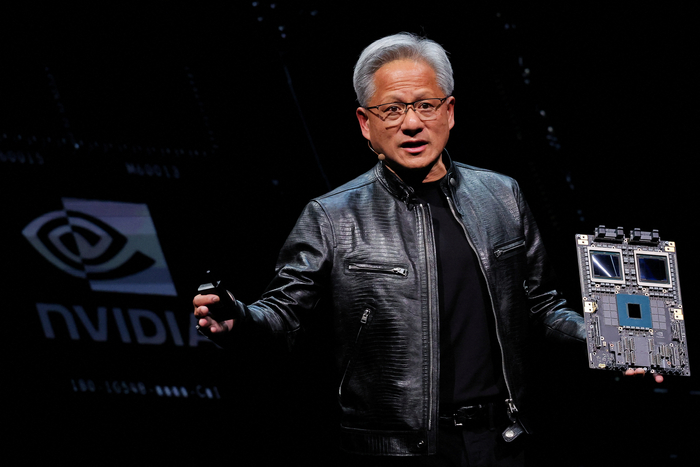

In recent weeks, the world of quantum computing has found itself in a turbulent state following remarks made by Jensen Huang, the CEO of NVIDIA. As a leading figure in the tech industry, Huang's statements about the timelines for the commercialization of quantum computers triggered a significant downturn in stock prices for multiple companies in this rapidly evolving sector. Understanding these developments is crucial for investors and enthusiasts of cutting-edge technology alike.

Stock Market Reactions to Quantum Predictions

On January 6, during a keynote at CES 2025, Huang suggested that it could take a full two decades before quantum computers are genuinely useful to the general public. His remarks led to drastic falls in related stock prices, with companies like IonQ, Rigetti, and Quantum Computing shedding values of 39%, 45%, and over 43%, respectively. This market reaction underscores the volatility in the technology sector, particularly in industries based on high expectation and speculation.

To further illustrate the impact, the stock of IonQ dropped to $30.25, representing a loss of $19.34 per share in a single day. This drastic change in market sentiment comes after a period of optimism fueled by technological advancements, such as

's announcement of a quantum chip capable of solving complex problems that would take current supercomputers a staggering 10 septillion years.

Why Did the Industry React So Strongly?

Huang’s predictions weren't just idle speculation; they reflected a well-founded skepticism within the industry. Despite the hype and investments from major players in tech, many start-ups have not yet turned a profit. For instance, while Rigetti saw its stock soar by an impressive 1,800% over recent months, it was still expected to close 2024 with just $11 million in revenue. This indicates that many quantum computing stocks may be more speculative than substantive at this stage.

Furthermore, Huang’s comments resonate beyond just market numbers. They hint at the underlying challenges that quantum computing faces, such as error rates, scalability, and the sensitivity of quantum processors to external interference. These technical hurdles serve as a reminder that while the dream of quantum computing technology remains bright, the journey towards achieving it is fraught with difficulties.

Counterpoints from Industry Leaders

Despite the pessimism, some industry leaders countered Huang's narrative. For example, Alan Baratz, CEO of D-Wave Quantum, expressed strong disagreement, arguing that quantum computers are already in use commercially with clients like

. Baratz emphasizes that the technology is not decades away; rather, it is operational as we speak.

This divergence in opinions highlights the complexities within the quantum computing landscape. While some companies are edging towards practical applications, others continue to navigate the choppy waters of research and development without tangible results on the horizon. This gives investors a mixed bag of prospects to consider.

Looking Ahead: The Future of Quantum Technology

The volatility seen in quantum tech stocks may serve as an eye-opener for prospective investors. As much as this niche market may seem promising, it is essential to approach it with caution. The last few years demonstrate that while quantum computing has potential, the timelines associated with its full realization may be much longer than speculated.

As noted by analysts, the quantum computing sector could indeed contribute significant value;

predicts potential value creation rocking into the trillions by 2035. However, for this to materialize, several technological and operational challenges must be resolved first.

Ultimately, Huang’s comments may have prompted an immediate decline in stock prices, but they also invite an important reflection on the promises and limitations of quantum computing technology. Investors must balance optimism with realism, understanding that the road ahead is likely to be long and winding, filled with both challenges and breakthroughs.