SoftBank's Comeback Fueled by AI Investments and IPO Success

Explore how SoftBank's strategic AI investments and successful IPOs are driving its impressive financial comeback and shaping the future of tech.

Key Points

- SoftBank

reported a net profit of 1.18 trillion yen, rebounding from a significant loss last year due to successful IPOs and improved investment valuations.

- The company's focus on artificial intelligence and strategic investments, including a $500 million stake in OpenAI

, positions it as a leader in future tech developments.

- SoftBank's cautious investment strategy and favorable market conditions, including a weaker US dollar, have contributed to its stronger financial standing and increased new investments.

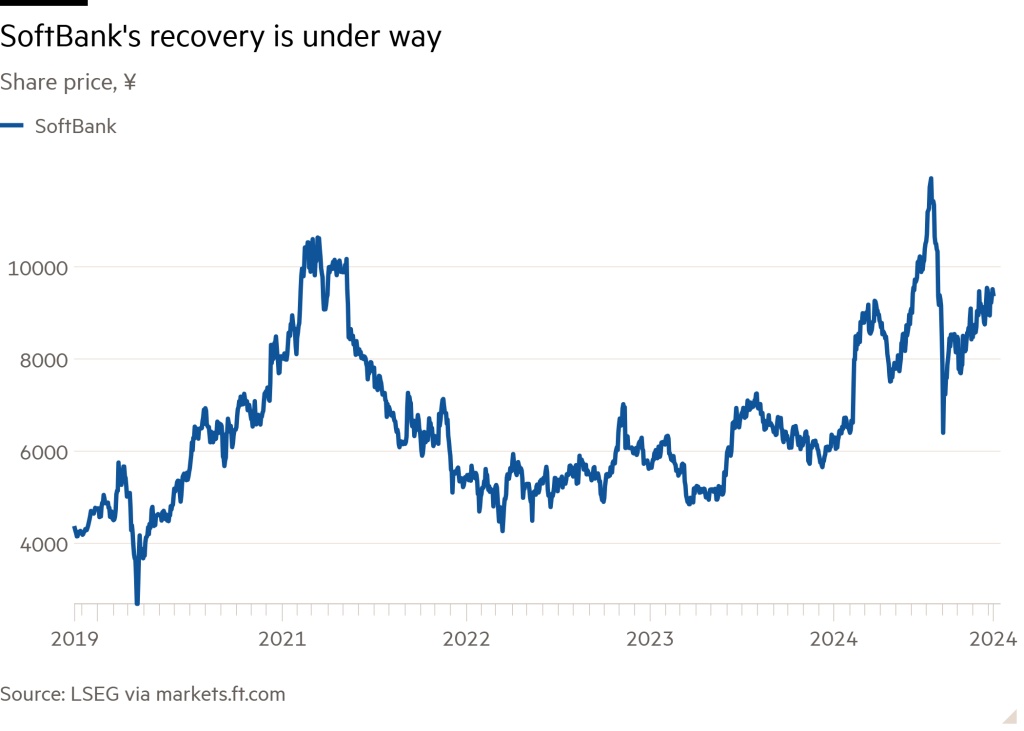

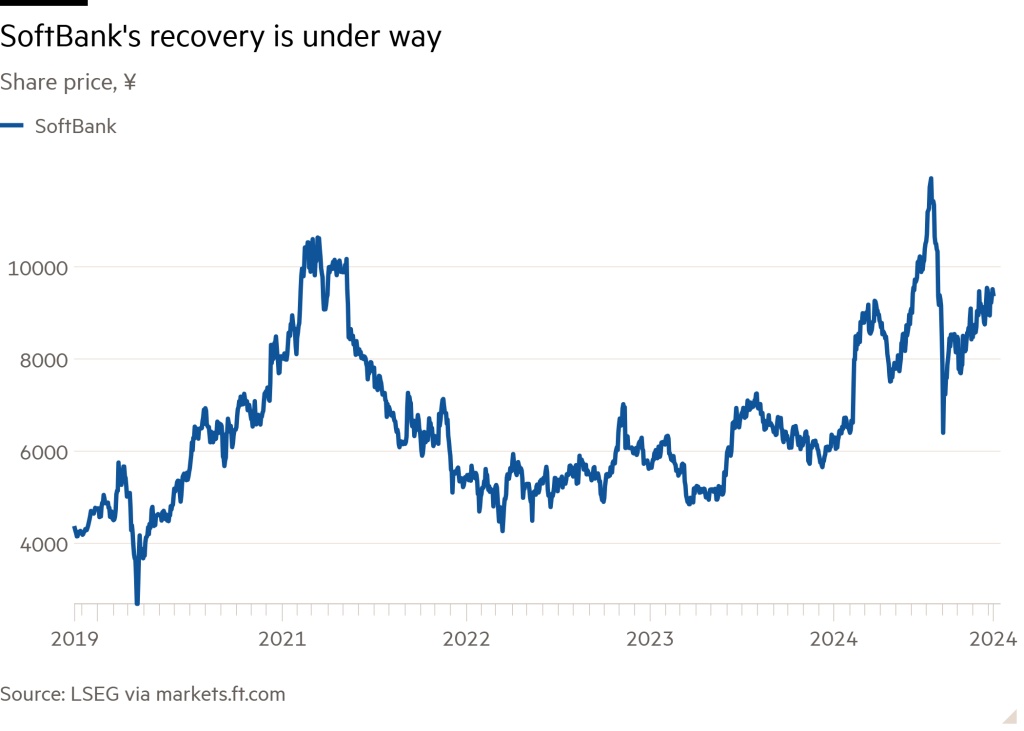

SoftBank Group, the Japanese technology investment titan, has recently reported a remarkable turnaround, boasting a net profit of 1.18 trillion yen (approximately $7.7 billion) for the July to September quarter. This significant leap follows a staggering loss of 931 billion yen in the same period last year, illustrating the company's resilience and strategic refocusing in a challenging market landscape. With this notable performance, investors and analysts alike are eagerly watching SoftBank as it positions itself for future growth, particularly in the burgeoning field of artificial intelligence (AI).

The Power of Strategic Investments

The key drivers behind SoftBank's impressive quarterly results were strong performances from its Vision Funds, fueled largely by successful initial public offerings (IPOs) in India. Noteworthy contributions came from companies such as

and Brainbees Solutions, both of which experienced exuberant demand during their IPOs. These events have been pivotal, generating substantial income and rejuvenating investor confidence in SoftBank’s portfolio.

Moreover, SoftBank’s cautious approach to investments, a necessary adjustment amid rising interest rates and market volatility, has begun to yield positive results. For instance, the valuation of its investments has started to recover, thereby enabling Vision Fund 1 to post an investment gain of 608 billion yen this quarter alone. According to Chief Financial Officer Yoshimitsu Goto, this is the unit's first time in positive territory in nine quarters, signaling a renewed sense of optimism for stakeholders.

AI: The Next Frontier

Perhaps the most exciting aspect of SoftBank's future strategy lies in its ambitious plans to dive deeper into artificial intelligence. The company has already committed substantial resources, including a significant $500 million investment in OpenAI. These investments are not merely transactional; they demonstrate

's ambition to align SoftBank with the next major technological breakthrough as the world gears up for a potential AI boom.

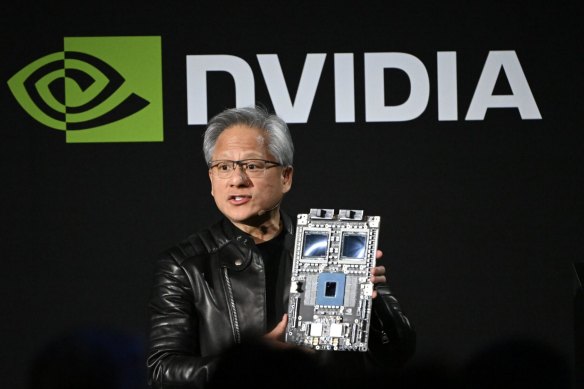

As AI continues to evolve, SoftBank's involvement in this sector could position it at the forefront of technological advancement, particularly if it can successfully develop AI chips that rival established players like

. With SoftBank's ownership of Arm, a key player in semiconductor design, the potential for innovative AI solutions is vast, ranging from enhanced computational power for data analytics to revolutionizing various aspects of everyday technology.

Global Markets and Future Opportunities

In addition to its strong performance in the tech sector, SoftBank's financial fortitude is apparent through its ability to adapt to global market conditions. The company has benefited from favorable exchange rates, particularly a weakened US dollar, which has enhanced its financial standing. This improved financial landscape is also coupled with a significant uptick in new investments—SoftBank has allocated $1.9 billion in the recent quarter—a dramatic increase from just $0.3 billion earlier in the year.

This growth aligns with broader market trends where companies are exploring new avenues to capitalize on technology's rapid evolution. Analysts are optimistic about SoftBank's ongoing commitment to innovation, especially as it gears up for further ventures in AI and technology infrastructure.

A Forward-Looking Vision

SoftBank's triumphant return to profitability underscores a larger narrative of resilience and strategic adaptation in the face of adversity. As the company navigates the complexities of high-stakes investments amid fluctuating market values, its focus on AI and sustainable growth will be pivotal.

By embracing a measured investment strategy while simultaneously pursuing groundbreaking technologies, SoftBank is not merely bouncing back; it is laying the groundwork for a more prosperous future. This current trajectory, underpinned by mass investments in dynamic fields, offers a compelling reason for both shareholders and industry observers to remain optimistic.

In summary, SoftBank's recent financial turnaround and strategic focus on AI present a promising outlook for the future. As the tech giant continues to refine its investments and embrace cutting-edge opportunities, we can anticipate exciting developments that may shape the tech investment landscape for years to come.