Peso Stability Amid U.S. Election Uncertainty and Market Dynamics

Discover how the U.S. election impacts the Mexican peso's recovery and the factors driving market volatility in this insightful analysis.

Key Points

- The Mexican peso has shown signs of recovery amidst U.S. election uncertainty, particularly as investors react to potential tariffs under Donald Trump

.

- Political dynamics and global economic factors, including U.S. monetary policy, significantly influence the peso's value and market volatility.

- Experts predict that election outcomes could lead to heightened economic instability for the peso, regardless of the presidential winner.

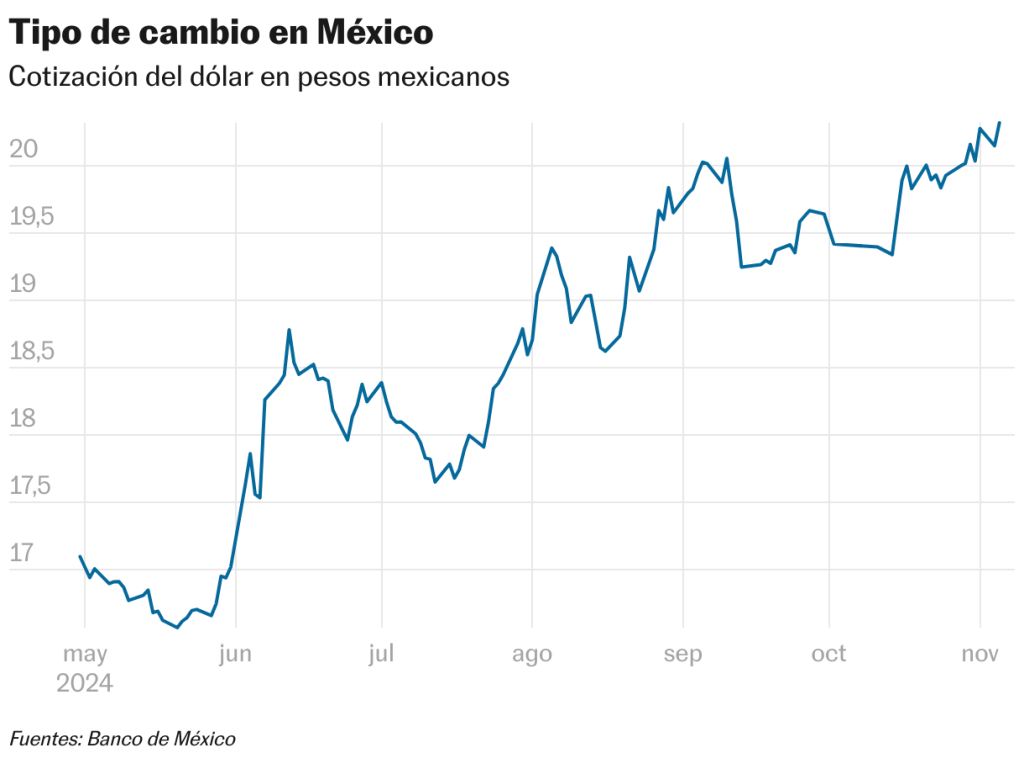

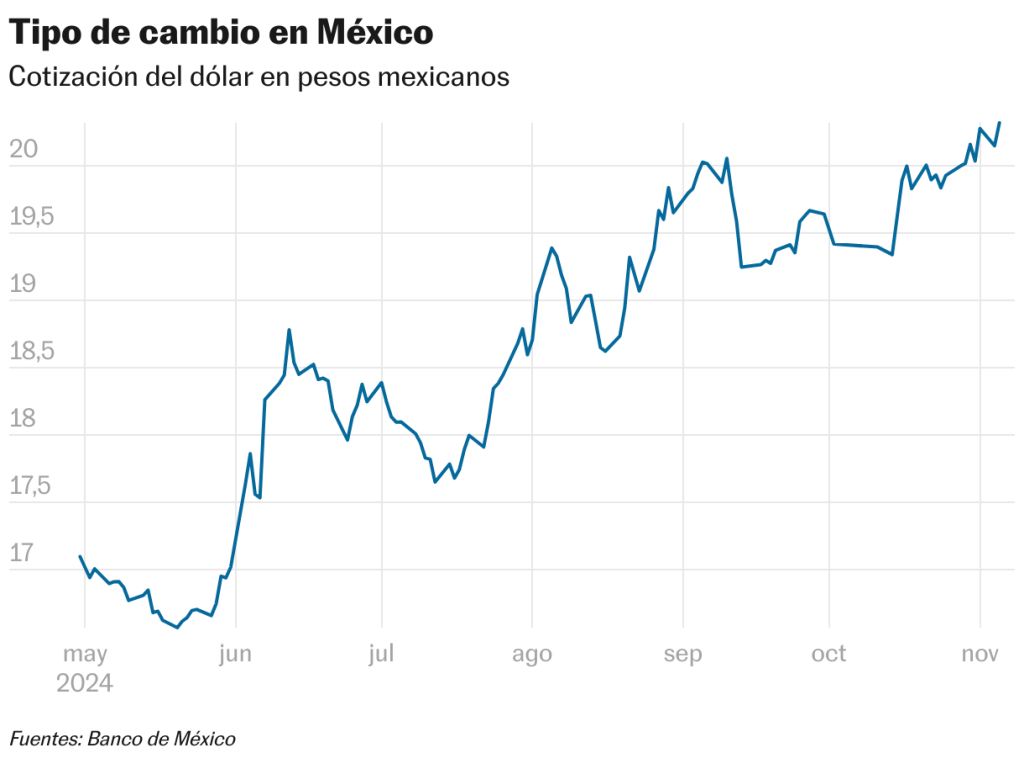

The Mexican peso has become an intriguing focus for investors as it negotiates the turbulent waters of electoral uncertainty in the United States. As the nation approaches the 2024 presidential elections, marked by a tight race and intense speculative sentiment, the peso has exhibited significant fluctuations. Despite reaching its lowest point in over two years at around 20.35 units per dollar, recent data suggests a potential reversal as the currency appreciates modestly before the elections.

The Market Reaction to Political Climate

The atmosphere leading up to the elections is fraught with caution. Investors are on high alert, concerned about the possible return of Donald Trump, who has made aggressive trade promises that could impact Mexican exports, notably through tariffs on products like automobiles. Such moves threaten to undermine the economic stability that Mexico has managed to sustain over recent years, particularly through agreements like the

(USMCA), which is due for review in 2026.

As Election Day draws nearer, analysts report significant volatility in the peso. For instance, prior to the elections, the peso appreciated to about 20.06 units per dollar, marking a slight gain. However, analysts anticipate that the final outcomes may not be immediately clear, leading to further fluctuations. This uncertainty is particularly evident as the markets brace for a potentially drawn-out vote count amidst claims by Trump of electoral impropriety if the results do not favor him. This can instigate additional apprehension among investors regarding the peso's future performance.

The Economic Context

The peso's performance over the last few months highlights a dramatic fall, with an approximate 19% depreciation since June 2023, primarily fueled by political concerns and local election outcomes. For Mexico, the stakes are high: a volatile currency can lead to inflated prices for imports and impact the nation's overall economic health. Observations in debt markets also show descending yields, indicating investor caution and a shift towards safer assets amidst financial uncertainties.

Moreover, local economic factors, including inflation and local policy decisions, add layers of complexity to the peso’s value. Recent reports indicate that the inflation rate remains a significant worry, prompting questions about monetary policy shifts by the

. These local economic trends compound the external pressures from the upcoming U.S. election cycle.

Investor Sentiment and Global Perspectives

It’s not only political maneuvering that affects the peso; global investor sentiment also plays a critical role. The anticipation surrounding the

's decisions on interest rates further intricately ties Mexico’s economy to U.S. fiscal policies. When the Fed raises rates, it typically strengthens the dollar and can diminish the peso’s appeal to foreign investors. Consequently, the relationship with U.S. monetary policies is crucial for understanding the behavior of the Mexican currency.

Looking ahead, regardless of who wins the presidency—Trump or Harris—both candidates present challenges that could lead to heightened economic volatility for Mexico. Analysts predict that a Trump victory might see the peso drop to around 20.50 units per dollar, while a win for Harris could offer some reprieve, allowing for stabilization closer to 19 units per dollar. Nonetheless, any post-election conflicts could plunge the peso into a further state of instability.

The Path Forward

The next few days and weeks are undoubtedly critical for the peso. As votes are counted and results begin to unfold, the market will respond not just to the political reality but also to the underlying economic indicators. Adapting to this uncertain landscape requires vigilance from investors and policy makers alike. The financial markets are acutely aware of the implications that both local and international dynamics carry for the future of the peso.

In summary, the path of the Mexican peso amid U.S. election turmoil illustrates broader themes of economic interconnectedness. While the currency has shown signs of recovery, looming political uncertainties and global economic factors present substantial challenges ahead. Understanding these dynamics will be essential for predicting the peso's trajectory in the months to come.