Nvidia's Stock Plunge and the Future of AI Investment

Explore Nvidia's dramatic stock plunge and its implications for AI investments as market volatility raises critical questions for investors and the tech sector.

Key Points

- Nvidia

's stock dropped 9.5%, resulting in a significant loss of $279 billion in market capitalization, reflecting growing investor caution.

- The decline raises concerns about the sustainability of AI investments, as recent forecasts failed to meet high expectations.

- Market volatility is expected to continue as economic data and interest rate cuts loom, posing further implications for the tech sector.

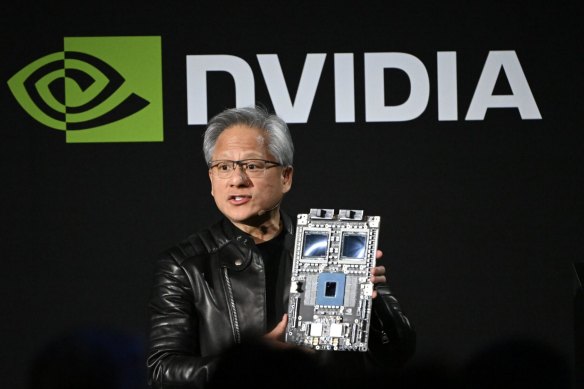

The recent turmoil in the stock market has sent shockwaves throughout the investment community, particularly with the staggering decline of Nvidia's stock. On September 3rd, the tech giant saw its shares plummet by 9.5%, erasing a remarkable $279 billion in market capitalization. This downturn has not only impacted Nvidia but also raised questions regarding the overall stability of the technology sector and the broader economy. In this blog post, we will explore the factors behind this significant market event, the role of artificial intelligence (AI) investment, and the implications for investors moving forward.

The Broader Market Context

Nvidia's decline occurred alongside a more extensive sell-off in U.S. stock indexes, as major technology companies faced considerable losses. The Nasdaq Composite Index dropped 3.3% and the S&P 500 fell 2.1%. With concerns about global economic growth weighing heavily on trader sentiment, investors were quick to reassess their positions, particularly in high-stakes sectors like AI and technology.

Market analysts have noted that September is often a precarious month for equities, with historical averages showing declines. In the last four years, the S&P 500 has had an average decline of 5.7% in September. Notably, previous years have seen drops of up to 9.3% during this month alone. This seasonal volatility adds an additional layer of complexity to understanding Nvidia's struggles.

The AI Investment Dilemma

One of the central issues attributed to Nvidia's stock plunge was the growing skepticism surrounding AI investments. Despite its reputation as a leader in AI technology, recent reports highlighted that Nvidia's quarterly forecast did not meet the high expectations set by investors. This disappointment triggered a deeper examination of whether the rush towards investing in AI is justifiable.

Multiple analysts, including strategists from

and

, have raised legitimate concerns about the viability of AI revenue. Michael Cembalest of JPMorgan pointed out that increased spending on AI will only be vindicated if demand for AI services grows among non-tech companies. This indicates that while the tech sector chomps at the bits to harness AI, the broader economic application and return on investment remain ambiguous.

Market Reactions and Future Outlook

The ramifications of Nvidia's decline extend beyond just its own stock price. Following the shocking news, other key players in the technology sector, such as Intel, also experienced significant drops, with shares falling nearly 9%. The

, which includes Nvidia, fell by 7.75%, marking the largest single-day decrease since 2020.

As we await significant economic data releases, including the upcoming U.S. jobs report, the market seems poised for further volatility. Many investors are keeping a close watch on interest rate movements from the

, with expectations of a possible 25 basis point cut looming ahead.

Despite these challenges, it is essential to remember that market corrections, while uncomfortable, can ultimately lead to reinvigorated growth. Experienced investors often recognize that cyclical downturns open doors for more substantial long-term opportunities. Future demand for AI technologies may very well rebound, especially as businesses across various sectors adapt and reshape their operational models.

Final Thoughts

The decline in Nvidia's stock is emblematic of broader concerns affecting technology investments today. While the immediate reaction from the market has caused apprehension, the long-term outlook remains promising for sectors that adapt to evolving demands. As investors navigate this volatile landscape, understanding the technology market's dynamics and maintaining a diversified portfolio will be crucial to weathering the storm. History has shown us that with patience and strategic assessment, investors can emerge from these challenging phases stronger than before.