Nvidia's Earnings Reveal AI Demand and Future Challenges

Nvidia's latest earnings showcase remarkable AI demand, yet supply chain challenges raise concerns about future growth and profitability prospects.

Key Points

- Nvidia

reported a 94% increase in third-quarter revenue, underscoring strong demand for its AI technologies.

- Despite exceeding revenue expectations, supply chain challenges and declining margins led to a mixed investor reaction.

- The continuing surge in AI investments from major tech firms highlights Nvidia's critical role in the evolving market landscape.

Nvidia, the juggernaut in the realm of graphics processing units (GPUs) and a key player in artificial intelligence (AI) technology, recently released its much-anticipated third-quarter earnings report. While the results exceeded many expectations, they fell short of the lofty aspirations some investors had set. The outcome stirred mixed reactions, prompting the company's shares to decline, highlighting the challenges that come with extraordinary growth in the ever-evolving tech landscape.

Strong Performance Amid High Expectations

For the third fiscal quarter, Nvidia reported revenues of $35.08 billion, a staggering 94% increase compared to the previous year. Additionally, the company posted an impressive net income of $19.04 billion, showcasing its ability to generate substantial profits amidst soaring demand for AI-driven technologies. These results far surpassed Wall Street's expectations of $33.2 billion in sales, creating a significant buzz among analysts.

Despite this outstanding performance, Nvidia forecasted fourth-quarter revenue guidance of approximately $37.5 billion, slightly above analysts' averages of $37.1 billion. Yet, it was the sentiment around anticipated slower growth and margin pressures that concerned investors. Expectations had been set extremely high given Nvidia's meteoric rise in stock prices this year, increasing nearly 200%. Consequently, any signs of a slowdown in expansion led to hesitance among stakeholders, causing a small decline of about 2% in after-hours trading.

The Impact of Supply Chain Challenges

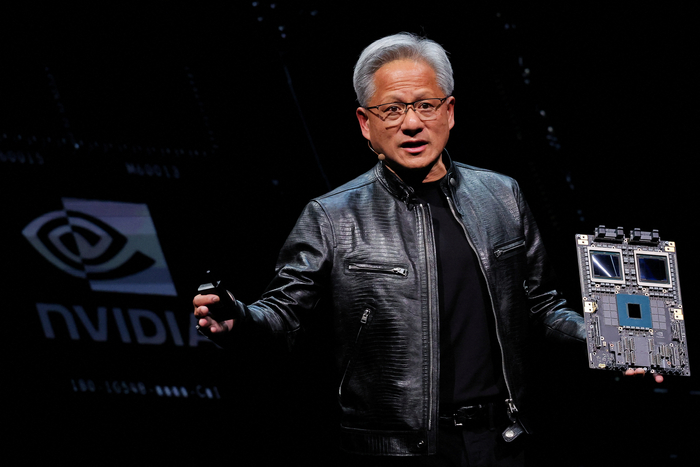

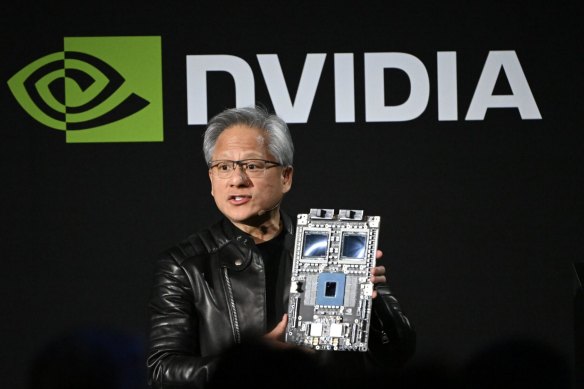

A primary driver behind the mixed reaction following the earnings report was Nvidia’s admission of ongoing supply chain challenges, particularly regarding its new Blackwell chips. These advanced chips are critical for the company’s future growth, yet production capacity constraints at its manufacturing partner TSMC have created bottlenecks. In light of these constraints, Nvidia’s CEO,

, stated that while demand is “insane”, managing supply to meet this demand is a challenge that needs addressing.

Moreover, Nvidia's gross margins are expected to decrease from 75% to around 73.6%, raising eyebrows among investors accustomed to continuous growth. The decline in margins reflects the increasing production costs and the evolving landscape of competitive pressures from other chip manufacturers like Intel and

who are also carving out their share of the burgeoning AI market.

The Unwavering Demand for AI and Future Prospects

Perhaps the most compelling takeaway from Nvidia's recent performance is the unwavering demand for its AI technologies. As leading tech firms invest heavily—over $240 billion this year—into AI capabilities, the need for high-performance GPUs is surging. Major players such as

,

, and

are all scrambling to keep up, optimizing their data center capabilities through Nvidia’s cutting-edge technology. This surge suggests that although Nvidia faces challenges, its foundational role in AI positions it well for future growth.

Investors looking at Nvidia might consider these fluctuations as temporary interruptions in an otherwise promising trajectory. During the earnings call, Huang emphasized that the paradigm shift towards AI is in full swing, further solidifying Nvidia's pivotal role in this transformation.

A Bright Future Amid Concerns

Overall, while Nvidia's recent earnings report stirred a mix of excitement and caution, the underlying demand for AI technologies remains robust. Analysts maintain a bullish outlook, attributing surging revenue expectations to the inevitable impact of AI on diverse industries. Despite the present challenges, Nvidia continues to innovate and adapt, signifying its resilience and potential for long-term success.

The future appears promising for both the company and its investors. As the AI boom unfolds, with new applications and technologies emerging rapidly, Nvidia is well-positioned to capitalize on this demand, reinforcing its standing as a leader in the semiconductor and AI industries.