Nvidia Reclaims Top Spot as AI Powerhouse in Tech Industry

Nvidia's surge to the top showcases the transformative power of AI, redefining the tech landscape and shaping future investments.

Key Points

- Nvidia

has surpassed Apple to become the world’s most valuable company, driven by explosive demand for AI technology.

- The company accounts for 75% of the world's AI accelerators, playing a crucial role in the growth of generative AI applications.

- With strong projections for future revenues and continued investment in AI, Nvidia is poised for sustained growth in the tech industry.

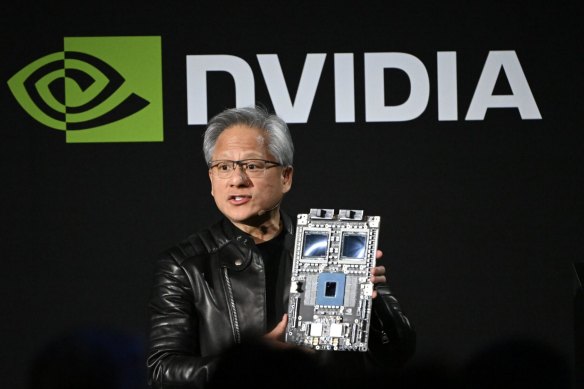

In an unprecedented turn of events, Nvidia has reclaimed its title as the world's most valuable company, surpassing industry heavyweight Apple. On November 5, 2023, Nvidia's shares surged by 2.9% to a market capitalization of $3.43 trillion, eclipsing Apple's $3.38 trillion. This shift not only marks a significant moment for Nvidia but also signifies the growing influence of artificial intelligence (AI) in today’s technology landscape.

The AI Boom Fueling Nvidia's Ascent

Nvidia's remarkable growth can be attributed to the skyrocketing demand for AI technologies. As the leading provider of AI accelerators, Nvidia designs about 75% of the world's semiconductor technology necessary for running generative AI applications, such as

's

. The company's net income has dramatically increased, rising from $2.3 billion in the first half of 2022 to an impressive $31.5 billion in the same period of 2024.

This surge in profitability is evident in Nvidia's stock performance, which has inflated more than 850% since the end of 2022. Investors are overwhelmingly optimistic, anticipating further advancements in AI that will solidify Nvidia's position at the forefront of this booming sector.

Competitive Landscape and Market Dynamics

The competition between tech giants is intensifying as companies like

,

, and Apple significantly invest in AI infrastructure. For instance, Microsoft's Azure cloud services and Alphabet's extensive AI innovations heavily incorporate Nvidia’s technology, making Nvidia a vital player in their growth strategies. Interestingly, even with Apple's robust business model—projecting revenues of $397 billion and a net income of $98 billion—its focus on AI products like the new AI-enabled iPhones has not insulated it from Nvidia's rapid market ascent.

Analysts suggest that the AI boom is not a fleeting trend but rather a long-term shift in technology that will continue to benefit Nvidia, projecting its revenues to more than double in the coming fiscal year. This insight highlights a crucial point: while traditional tech giants are vying for position, those who supply the underlying technology—like Nvidia—stand to gain the most.

A Bright Future Ahead

The momentum behind Nvidia's rise not only demonstrates the company's ability to adapt but foretells a future where AI is an integral part of innovation across various sectors. With strong backing from both established firms and startups, Nvidia is set to become even more central in the development of next-generation AI applications. This trajectory ensures that investments in AI infrastructure will continue, banking on Nvidia's pivotal role in this evolution.

As Nvidia prepares to join the prestigious

, this placement further validates its status as a leading tech giant. Such a move typically indicates a favorable investment climate and tends to attract funds and interest, propelling further growth.

Implications for Investors and the Tech Industry

For investors, this transition represents a crucial pivot point. The AI sector's rapid expansion is creating numerous opportunities. Companies that strategically align with AI technologies—like those harnessing Nvidia’s powerful chips—are likely to thrive. Investment banks have already adjusted their forecasts, expecting Nvidia's growth will persist well into 2026, with anticipated profits nearing $122 billion.

With such potential, the landscape of the tech industry is evolving, creating both challenges and opportunities for companies and investors alike. As we move forward, understanding the implications of AI advancements and Nvidia's central role will be imperative for capitalizing on these developments.

Nvidia's ascendance as the world's most valuable company underscores a significant shift in the tech landscape—one that is being driven by the explosive growth of artificial intelligence. As they continue to innovate and lead in AI technology, stakeholders should remain vigilant and embrace the potential that AI has to reshape business practices and investment strategies in remarkable ways.