Nvidia Faces Antitrust Inquiry Amid Stock Market Turmoil

Nvidia's stock plummets amid a DOJ antitrust investigation, raising concerns about competition and the future of AI technology investment.

Key Points

- Nvidia

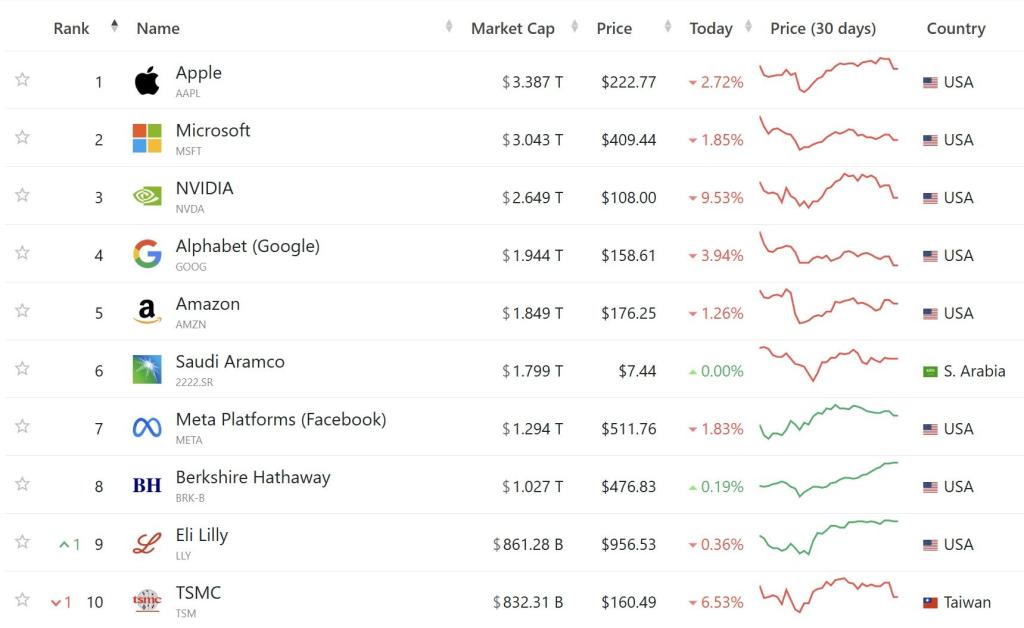

faces a significant stock market decline of 9.5% amid a DOJ antitrust investigation regarding potential anti-competitive practices in the AI chip market.

- The scrutiny highlights growing investor skepticism about the immediate profitability of AI technologies and the sustainability of corporate valuations.

- Despite current challenges, analysts maintain that the long-term growth prospects for the semiconductor industry and AI remain optimistic.

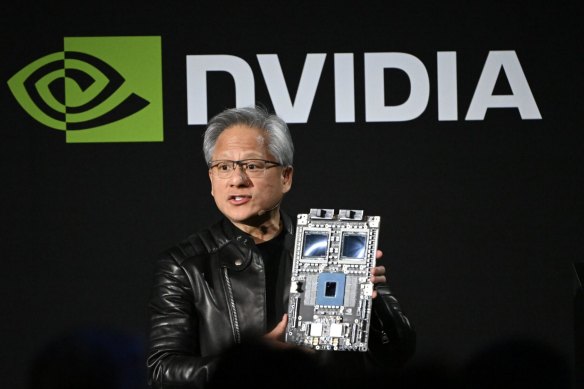

In recent weeks, Nvidia, the leading force in AI hardware and semiconductor technologies, has found itself in a precarious position. Following a substantial drop in its market capitalization—losses reaching around $280 billion—the company is now facing a serious antitrust investigation from the

(DOJ). This development has not only rattled Nvidia investors but has also sparked a broader discussion about the implications of corporate dominance in emerging tech sectors.

Understanding the Antitrust Concerns

The crux of the DOJ's investigation revolves around allegations that Nvidia may be engaging in anti-competitive practices. Reports indicate that the company could be exerting undue pressure on clients who wish to consider alternatives to its products, particularly in the lucrative AI chip market where Nvidia holds over 80% market share. This situation raises important questions about fair competition, particularly as various companies endeavor to harness AI technology for their operations.

According to

, the inquiry is focused on whether Nvidia has unlawfully coerced clients into purchasing their chips while simultaneously penalizing those who consider rival suppliers. This scrutiny reflects a broader concern within the industry about how market leaders leverage their power to maintain dominance.

Market Reactions and Broader Implications

The announcement of the investigation had immediate repercussions on Nvidia's stock, which plummeted by 9.5% in a single day, marking one of the largest single-day losses ever experienced in the U.S. tech sector. Comparatively, such drastic downswings were also noted during

' downturn in February 2022. Investors are increasingly wary, as evidenced by a pervasive sentiment shift towards caution in the sectors heavily reliant on tech investments.

Furthermore, as a result of Nvidia's decline, the semiconductor sector observed a noticeable ripple effect. Stocks of other major players like Intel and

also experienced declines of 8.8% and 7.8%, respectively. These figures illustrate how closely interlinked the tech sector is, where the performance of one company can significantly impact others.

Investor Sentiment Towards AI Technologies

As Nvidia's market dynamics evolve, several analysts point to greater investor skepticism regarding the profitability of burgeoning AI technologies. While investments in AI have surged, stemming from an optimism that revolutionary outcomes will manifest, the realization of immediate returns remains uncertain. Michael Cembalest from

noted, “Investors are looking past GPU sales” and are starting to question the viability of their substantial expenditures.

This sentiment is critical, considering that the returns from AI investments need to be substantiated over time to maintain and grow investor confidence. The once-unwavering belief in unbounded growth now requires a more measured approach as investors contemplate the sustainability of these valuations.

A Potential Path Forward

Despite ongoing challenges, many analysts believe that the semiconductor industry's long-term growth prospects remain intact. As Luke Rahbari, CEO of Equity Armor Investments, discussed, Nvidia's recent performance suggests a need for growth stabilization rather than a complete downturn. Given the significant demand for AI-related technologies, it is reasonable to believe that a recovery could emerge, but it will take time and adjustments.

The future of Nvidia and its competitors within the semiconductor space hinges not only on navigating legal challenges but also on their ability to adapt amidst a shifting investor landscape. As the tech sector reflects on its recent upheaval, firms may need to prioritize transparency and fair market practices to regain and sustain trust.

Moving forward, it is essential for investors and industry stakeholders to remain keenly aware of the evolving marketplace dynamics and the implications of regulatory scrutiny. The conversation surrounding antitrust laws and corporate responsibility in tech will continue to gain momentum, fostering a renewed focus on fair competition that serves both consumers and industry health.