Nvidia Earnings Report to Shape Tech Market Future

Nvidia's upcoming earnings report could redefine the tech landscape, influencing market trends and investor strategies in a rapidly evolving industry.

Key Points

- Nvidia

's upcoming earnings report is crucial for assessing the health of the tech sector amid rising expectations and market volatility.

- The company's significant growth, driven by AI demand, positions it as a bellwether influencing broader market trends and investor strategies.

- Investor sentiment is mixed, with options predicting a potential 10% swing in Nvidia's stock following the earnings announcement, reflecting high stakes in the report.

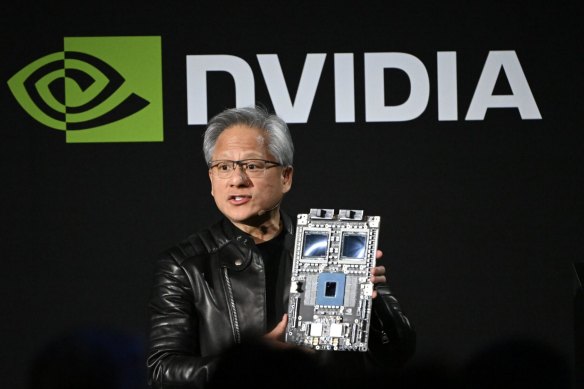

As the global markets continue to navigate through an era defined by rapid technological advancements and inflationary pressures, all eyes are turning to Nvidia, a leader in the artificial intelligence (AI) and semiconductor sector. This week, Nvidia is poised to release its quarterly earnings report, an event that many believe could either solidify its position as a market powerhouse or signal potential vulnerabilities within the technology sector.

Market Reactions Leading Up to the Report

The anticipation surrounding Nvidia's quarterly performance has already significantly influenced stock behavior across major indices. On August 28, the

,

, and

all reported declines as investors adopted a cautious stance ahead of the earnings announcement. Specifically, the Nasdaq dropped by 1.12%, reflecting heightened volatility linked to Nvidia's impending performance update. This cautious sentiment is a clear indication of how centralized Nvidia has become in shaping market perceptions and movements.

The Impact of Nvidia's Performance

Nvidia's position as a bellwether for the tech industry cannot be overstated. Following several quarters of exceptional growth driven by demand for AI technology, investors are now on edge. Market observers forecast that Nvidia's second-quarter revenues may have doubled compared to last year, placing their anticipated earnings even under greater scrutiny. However, if these expectations fall short, it could lead to a significant correction not only for Nvidia’s stock but also for other major players in the tech sector.

Historical Context and Current Trends

The massive growth Nvidia has experienced—approximately a 3000% increase in stock price since 2019—is seen not just as an isolated success but as representative of the wider growth in the tech industry. This raises the question of sustainability. Market analysts suggest that the recent rise in demand for AI solutions has compelling implications for capital investment across the tech sector. With many companies remaining reliant on technology for future growth, Nvidia's upcoming earnings are not merely corporate numbers; they represent a litmus test for the health and resilience of the entire industry.

Investor Behavior and Market Strategies

With major market indices showing mixed results leading up to Nvidia's earnings call, investor strategies are also evolving. According to trading data, options are indicating a projected swing of around 10% following Nvidia's earnings report. This expected volatility highlights the indecision among investors and points to the larger market implications tied to Nvidia's performance.

Furthermore, firms and market strategists are weighing heavily on Nvidia’s earnings as a predictive marker for broader economic recovery or downturns. For instance, the recent uptick in AI investments from giants like

and

underscores the critical nature of Nvidia's technological offerings in shaping future corporate strategies.

Looking Ahead: Broader Economic Implications

As Nvidia prepares to release its report, several critical economic indicators also loom on the horizon. For example, the

's decision regarding interest rates in September will likely depend on economic momentum reflected in earnings reports and inflation rates. This interplay between technology sector performance and broader macroeconomic policies exemplifies the interconnectedness of modern financial markets.

Final Thoughts on Nvidia's Earnings and Future Prospects

In summary, Nvidia's earnings report will serve as a pivotal benchmark for the tech sector and beyond. The upcoming financial disclosures are not just about the company itself but reflect wider trends in AI adoption, investor sentiment, and macroeconomic stability. As markets fluctuate in response, investors are reminded of the dual nature of risk and opportunity that defines the current landscape. The outcome of Nvidia's earnings could very well set the tone for market trajectories in the months to come.