Nvidia Earnings Report to Shape AI Investment and Tech Trends

Nvidia's upcoming earnings report could redefine AI investment trends and impact the entire tech sector, making market sentiment critical to watch.

Key Points

- Nvidia

's earnings report is expected to significantly influence market sentiment and the trajectory of AI investment in the tech sector.

- The company anticipates reporting substantial revenue growth, yet faces concerns about future performance and potential market volatility.

- Investor focus on Nvidia's innovations and production timelines highlights its critical role in shaping broader tech trends and risks.

The tech industry has been abuzz with excitement as investors prepare for Nvidia's upcoming earnings report. Expected to be released after the market closes on Thursday, this report is not just another quarterly update; it holds the potential to reshape market sentiment and influence the trajectory of the technology sector, particularly within the realm of artificial intelligence (AI).

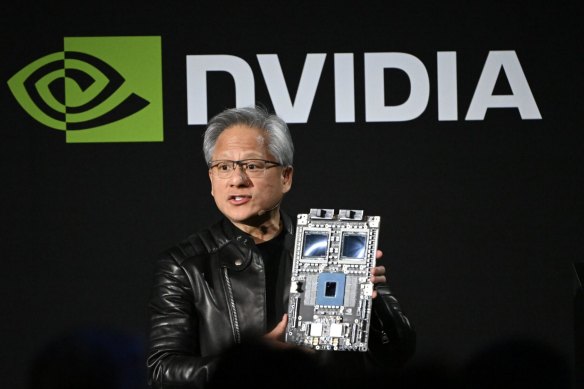

Nvidia's Dominance in AI and Semiconductor Industry

Nvidia has emerged as a pillar in the AI boom, with its advanced graphics processing units (GPUs) being integral to many companies' AI ventures. Currently, the company boasts a staggering market capitalization of approximately $3.11 trillion. This dominance positions Nvidia as a vital indicator of AI investment trends and the semiconductor industry's health.

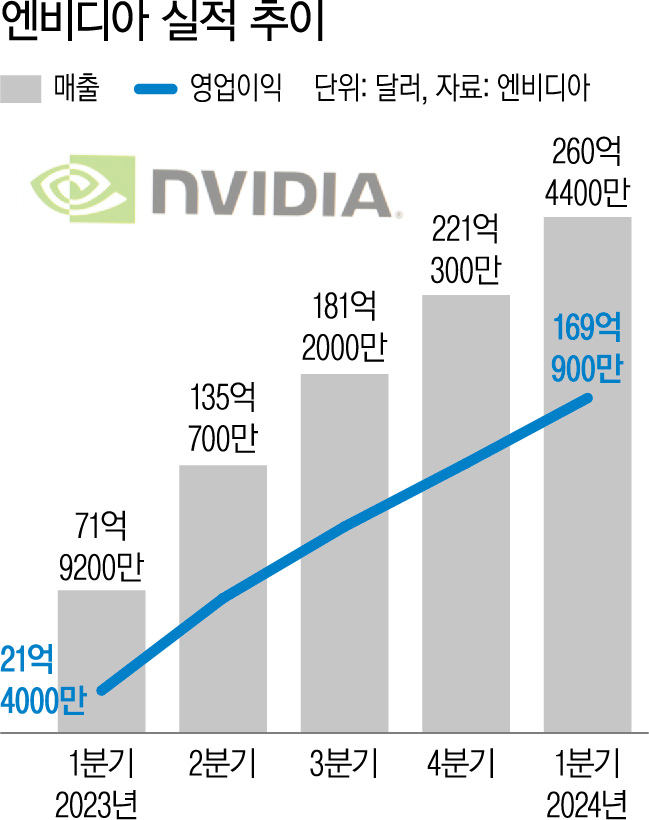

In the second quarter, Wall Street anticipates Nvidia will report earnings of 65 cents per share on revenue of about $28.74 billion, an impressive climb from $14 billion the previous year. This growth is largely attributed to the surging demand for generative AI applications, which rely heavily on Nvidia’s technology.

However, analysts have warned that such rapid growth cannot sustain itself indefinitely. According to Ted Mortonson of Baird, while Nvidia continues to ship products to major clients like

and

, a deceleration in growth should be anticipated. This makes it paramount for investors to closely monitor the earnings report for signals regarding the company's future outlook.

The Market's Expectations and Risk Factors

In preparation for this earnings report, options traders are predicting a remarkable swing in stock prices, with an expected volatility of around 9.8% following the earnings announcement. This projection translates to a potential market move exceeding $300 billion, marking it as one of the largest potential shifts in history.

Given that Nvidia accounts for a significant portion of the

's gains this year—about 30%—its performance could set the tone for the tech market overall. The lingering questions around Nvidia’s innovative capacity and its ability to meet or exceed expectations set a high-stakes scenario. Should the company fall short, it could trigger a 'risk-off' sentiment in the markets.

The Broader Implications for Investors

The implications of Nvidia’s earnings extend beyond just its stock price. If the report shows significant revenue growth, it may bolster investor confidence in AI and related sectors, likely boosting the stock prices of other tech firms. Conversely, any sign of weakness in demand or revenue could lead to ripple effects across the market, causing declines in stock prices for other tech companies as well.

Furthermore, with many investors fixating on the potential release of Nvidia's next-generation GPUs, any mention of production delays could stoke further anxiety. This convergence of anticipation and uncertainty encapsulates the unique position Nvidia holds in the market right now.

A Future Driven by AI and Innovation

As the tech landscape evolves, Nvidia's path is closely watched, not only for its technological advancements but also for market dynamics. Its ability to continually innovate while managing growth reflects broader trends in the tech industry. Given the current economic climate characterized by rising interest rates and fluctuating market sentiment, Nvidia's results could provide critical insights into future investment strategies.

This earnings report, likened to a 'Super Bowl' among investors, symbolizes the potential highs and lows of the ever-evolving tech industry and its reliance on AI. The upcoming days will prove crucial, with investors keenly awaiting the numbers and guidance that could act as the fulcrum for future market movements.

In summary, Nvidia's forthcoming earnings report represents more than just a company's financials—it is a vital indicator of AI investment momentum and tech sector health. The stakes are high, and the implications extensive, making this a pivotal moment for both investors and the broader market.