Nvidia Earnings Report Showcases AI Growth and Challenges

Nvidia’s earnings report reveals impressive AI growth while addressing challenges ahead, signaling key market insights for investors to consider.

Key Points

- Nvidia

reported a remarkable 94% revenue increase, driven largely by its dominant position in the AI data center market.

- Despite its successes, concerns over production challenges and market saturation may challenge Nvidia's future growth trajectory.

- The company must navigate potential headwinds while capitalizing on emerging opportunities in sectors like healthcare and autonomous vehicles.

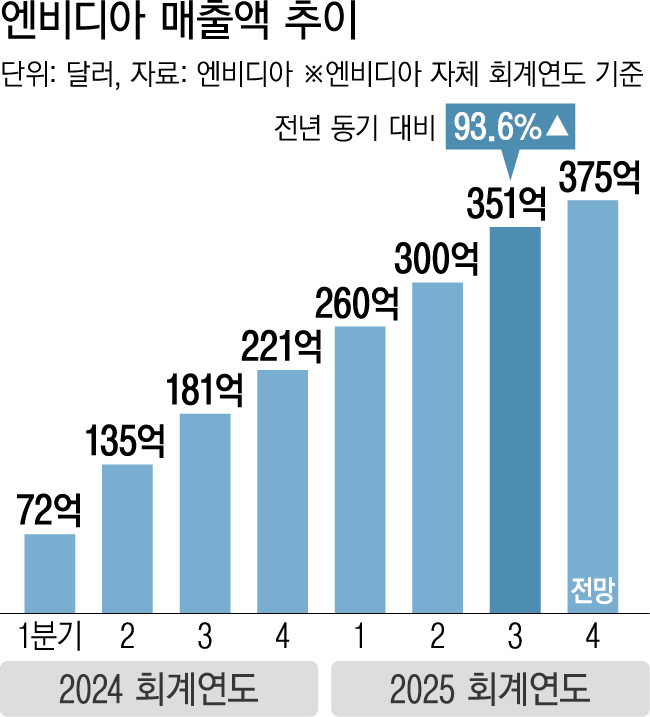

Nvidia has once again proven its dominance in the tech sector with an impressive earnings report for the third quarter of the fiscal year. The company reported revenues of $35.08 billion, a staggering 94% increase from the previous year, which clearly illustrates Nvidia's pivotal role in the artificial intelligence (AI) boom. But while the numbers are impressive, they come with a set of challenges that investors must consider. Let's dive deeper into the key highlights of this report and what it means for Nvidia moving forward.

Record Growth in AI Datacenters

The most significant driver of Nvidia's growth has been its AI-heavy data center segment, which has seen revenues soar from $3.8 billion in 2022 to an astonishing $30.8 billion. This explosive growth is intricately linked to the generative AI surge, highlighting Nvidia’s crucial role in powering the technology that is shaping various industries. Companies are increasingly reliant on Nvidia’s GPUs to train complex AI models, making their hardware and software solutions indispensable in the current tech landscape.

Market Position and Competitors

With a commanding market share—providing around 90% of the chips used for AI training—Nvidia stands well ahead of its competitors. Giants like

,

, and Meta are among those investing heavily in Nvidia's technology to build their AI infrastructures. However, as analysts have pointed out, the excitement surrounding AI is tempered by the reality of increasing market expectations. The recent earnings report did exceed Wall Street expectations, but growth rates are starting to level off, which raises questions about the continued momentum of the AI market.

Potential Challenges Ahead

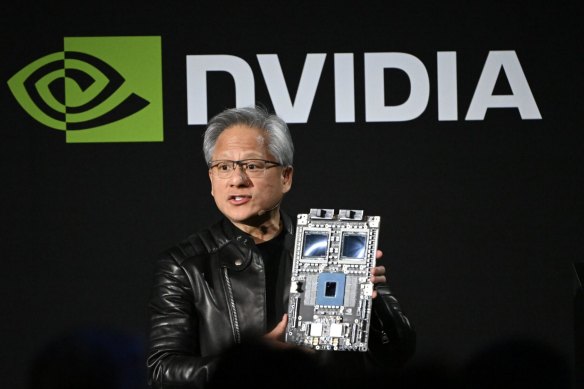

Despite its successes, Nvidia faces potential headwinds. Concerns are arising around its new Blackwell AI chips, which have been reported to overheat in certain conditions. Production delays and supply chain issues could hinder Nvidia's ability to meet the burgeoning demand for these advanced chips. Additionally, there is a growing apprehension that the generative AI gold rush might plateau as innovations in AI technology become increasingly complex and less predictable.

Furthermore, Nvidia's reliance on third-party clients, such as

, introduces additional uncertainties. Ongoing questions regarding Super Micro's accounting practices could impact Nvidia's financial stability if these partnerships are weakened.

Looking Forward: AI's Role in Nvidia’s Strategy

Moving forward, Nvidia's strategy will need to adapt to these challenges while capitalizing on the growing demand for AI. The company’s GPUs will likely continue to play a critical role, particularly with increased investments in healthcare, autonomous vehicles, and metaverse developments—areas where Nvidia can showcase the effectiveness of its technology. Even with the headwinds, the long-term outlook for AI and data centers offers a bright future for Nvidia, provided it can navigate the current landscape effectively.

In summary, Nvidia's third-quarter report showcases a company that is not only thriving in a rapidly evolving tech landscape but also tackling significant challenges head-on. With sustained growth within its AI segments and a strong market position, Nvidia remains a key player in shaping the future of technology. Investors should remain vigilant, however, as the landscape continues to change with both risks and opportunities on the horizon.