NVIDIA Earnings Impact Market Sentiment and AI Expectations

Explore how NVIDIA's earnings report highlights market expectations and the evolving landscape of AI, urging investors to diversify in today’s volatile tech sector.

Key Points

- NVIDIA reported impressive earnings, but its stock fell nearly 7% due to failing to meet high investor expectations for future revenue.

- The reaction highlights the precarious balance between remarkable innovation in AI and the pressures of market sentiment on tech stocks.

- Investors are encouraged to consider diversification strategies as volatility in the semiconductor sector increases amid heightened expectations.

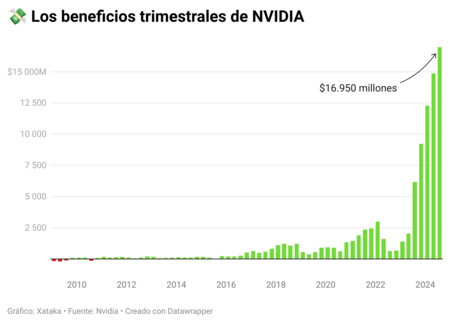

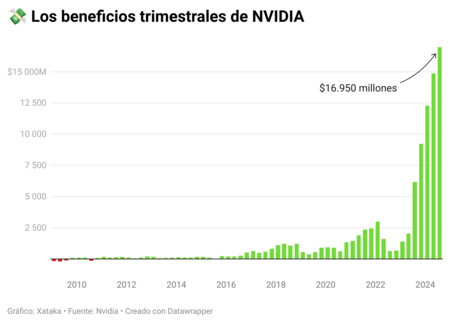

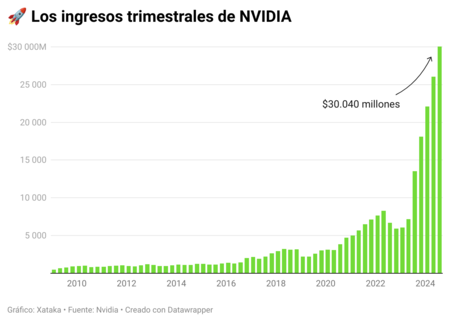

The tech world was abuzz recently when NVIDIA released its quarterly earnings report, an event that many viewed as a bellwether for the entire semiconductor industry. With expectations reaching dizzying heights, the company’s results were closely scrutinized, and yet, despite showcasing impressive numbers, the stock took a significant hit. This paradox raises critical questions about market expectations and the sustainability of tech stock momentum amidst fluctuating investor sentiment.

However, the situation took a turn when the market reacted negatively, leading to a nearly 7% decline in share price during after-hours trading. It is clear that the market had anticipated even more robust growth, particularly regarding future revenue forecasts. Analysts had been eyeing projections between $33 billion and $34 billion for the next quarter—expectations that NVIDIA’s guidance of $32.5 billion fell short of.

Market Reactions: A Reflection of Investor Sentiment

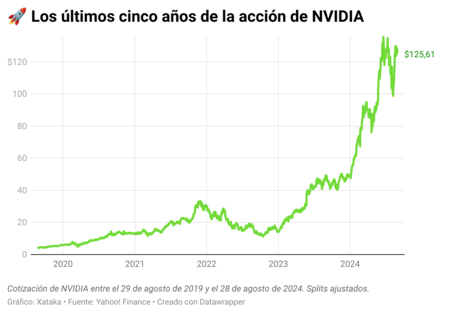

This notable drop in NVIDIA's stock reflects a broader trend in the tech market, where even stellar financial results can lead to significant corrections when they fail to meet heightened investor expectations. As market strategist Dana Ives aptly noted, “NVIDIA has become a victim of its success”. As the stock has skyrocketed over 180% this year alone, it’s clear that any perceived slowdown can lead to swift changes in investor sentiment.

Moreover, this correction was not limited to NVIDIA alone. The broader semiconductor sector, including major players like TSMC and South Korea’s

, felt the tremors as their stocks also faced declines. Such a collective downturn suggests that investors are not just reacting to NVIDIA but are taking a cautious stance towards the entire tech landscape, particularly in light of recent economic uncertainties.

Leadership in AI: A Double-Edged Sword

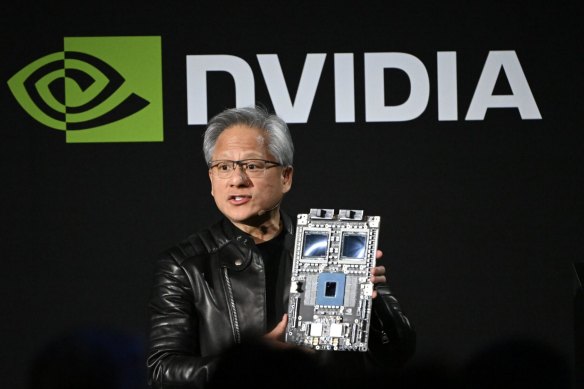

NVIDIA’s prowess in the AI sector underscores its position as an industry leader, yet this same leadership comes with the burden of elevated expectations. CEO

’s assertion that “the AI revolution remains in its early innings” only adds to the anticipation surrounding future product developments, including the pivotal launch of its Blackwell chip. However, the complexities of production issues and supply chain challenges add layers of uncertainty.

Market analysts now advise investors to consider diversification, highlighting the importance of not placing all their bets on a single stock or sector. Given the current market dynamics, it may be prudent to look beyond the immediate frenzy surrounding NVIDIA and explore other opportunities across the tech landscape. For instance, emerging companies focusing on cutting-edge chip technology may offer fresh potential without the pressures tied to NVIDIA's lofty valuation.

In the end, NVIDIA’s quarterly earnings report serves as a crucial reminder of the delicate balance between innovation and market expectations. While the company continues to push the envelope in AI technology, the accompanying investor sentiment demands careful navigation. By acknowledging the market’s volatile nature and embracing a more diversified investment strategy, stakeholders can position themselves for success even amid uncertainty.