Nvidia Earnings Forecast and Impact of Blackwell GPUs

Explore Nvidia's upcoming earnings and the impact of Blackwell GPUs on its impressive growth trajectory in the booming AI market.

Key Points

- Nvidia

's upcoming earnings report is expected to reveal record revenue and earnings, driven by strong demand for AI-driven technology.

- The launch of the Blackwell GPU architecture is critical for future growth, with projected revenues between $5 billion to $8 billion next quarter.

- Investors should stay cautious amid stock volatility, balancing excitement over Nvidia's growth potential with the risks of unmet targets.

Nvidia Corporation, a titan in the semiconductor industry, is poised to release its highly anticipated third-quarter earnings report soon. With expectations running high following an impressive year, many investors are on the edge of their seats, eager to see if Nvidia can maintain its upward trajectory amidst a roaring demand for AI-driven technology. As the company steps into the earnings spotlight, it’s essential to analyze what lies ahead for the stock, which has already experienced an astonishing growth of over 200% year-to-date and a staggering 850% increase since the onset of the AI boom.

Rising Expectations and Strong Projections

The upcoming earnings report is expected to underscore Nvidia's dominance in the AI and GPU market. Analysts anticipate that the company may report a record revenue of approximately $33 billion for the third quarter, with earnings projected to reach around $0.74 per share. This would represent a remarkable year-over-year growth rate of more than 80%. Such impressive forecasts highlight Nvidia's pivotal role in the AI revolution, powering critical applications in gaming, data centers, and professional visualization.

The demand for Nvidia's premium products is fueled by a significant uptick in capital expenditures from major tech companies who are racing to integrate AI capabilities. Notably, companies like

and

are projected to ramp up their spending next year, with total AI-related capital expenditures exceeding $240 billion. Nvidia stands to gain immensely from this trend, with increasing orders anticipated for its next-generation Blackwell GPU architecture.

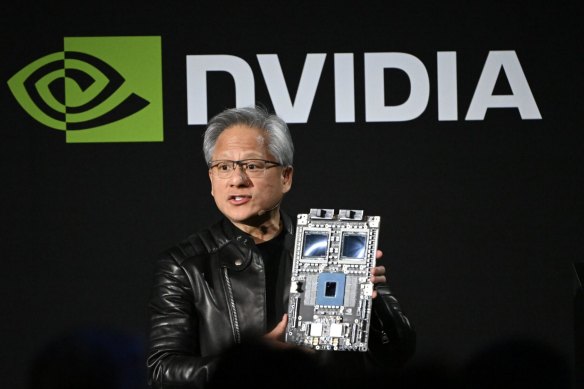

The Importance of Blackwell

At the forefront of investor attention is Nvidia’s latest GPU architecture, Blackwell, which is expected to drive substantial revenue growth in the coming quarters. Although challenges regarding production ramp-up have been highlighted, experts suggest that the demand for these new chips remains robust. Some estimates put Blackwell's revenue potential between $5 billion to $8 billion for the next quarter alone, indicating strong market confidence despite logistical concerns. This projection is critical because it not only reflects Nvidia’s current performance but also sets the tone for its future growth.

Market Sentiment and Stock Performance

The stock's volatility is another aspect investors must consider. Historical data shows that Nvidia shares often exhibit significant price movements post-earnings; on average, the stock can swing by as much as 8%. With the stock trading near all-time highs, any disappointing results could lead to sharp declines. Conversely, a strong earnings beat could propel the stock to new heights.

Nvidia's recent stock performance, hitting record highs of around $148, shows the market's faith in the company as a leading player in the semiconductor and AI sectors. However, there are also warning signs. A failure to meet ambitious targets could lead to an equally swift pullback. Analysts are keenly observing these dynamics as they assess the long-term growth potential versus the current market price.

Investor Considerations and Final Thoughts

Amid the optimism surrounding Nvidia, it's essential for investors to stay grounded. The aggressive development roadmap and consistent revenue growth showcase Nvidia as a strong contender in the tech landscape. Still, the uncertainties associated with production volumes and potential market corrections can impact investor returns. Therefore, patience should be exercised as Nvidia navigates through this evolving market.

As Nvidia prepares to unveil its earnings, investors will be looking for concrete signals regarding demand for Blackwell and overall revenue growth. With the rising trend of AI spending and Nvidia’s dominant market position, the company stands poised for substantial rewards. However, volatility remains a real risk, requiring investors to balance excitement with caution. Transitioning into 2025, the investment landscape for Nvidia could be incredibly rewarding, provided it continues to execute its ambitious growth strategy.