Nvidia Earnings Awaited to Impact Tech Market and AI Future

Nvidia's earnings report could reshape the tech market, with expected growth highlighting its pivotal role in the AI revolution.

Key Points

- Nvidia

is expected to report a remarkable revenue growth of approximately $28.7 billion, reflecting a significant impact on the tech sector.

- The company's performance and future product launches, particularly the Blackwell chip, will influence investor sentiment and market dynamics.

- Nvidia's dominance in the AI chip market positions it as a critical driver of innovation and economic momentum within the technology landscape.

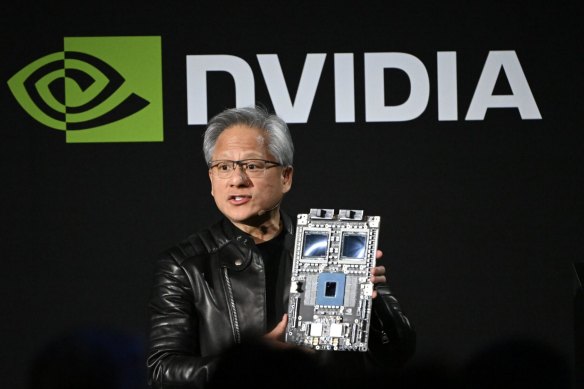

Nvidia, the powerhouse of artificial intelligence (AI) chips, is amidst a storm of anticipation as it prepares to disclose its second-quarter earnings. With a staggering market cap valued at around $3 trillion, Nvidia not only dominates the AI chip sector but also plays a crucial role in shaping market trends across the technology landscape. As investors hold their breath, it’s essential to understand the implications of Nvidia's performance and its ripple effects on the broader market.

Market Influence and Expectations

As Nvidia approaches its earnings report, expectations are soaring. Analysts predict a revenue leap to approximately $28.7 billion, reflecting a remarkable growth of over 112% compared to the same period last year. This anticipated performance is not merely a number; it symbolizes Nvidia's integral position in the AI revolution, as the company captures around 90% of the global market for AI training and inference chips.

The upcoming results are critical because they are expected to resonate throughout the entire tech sector. Analysts have likened Nvidia's performance reports to essential economic indicators, driving investments and sentiment in a market still recovering from recent volatility.

Impact on Investor Sentiment

Investor sentiment leading up to the earnings announcement is charged with both excitement and caution. According to options traders, Nvidia's stock is projected to experience swings of up to 10% either way post-announcement—a significant fluctuation that underscores how pivotal these earnings are. Such volatility isn’t isolated; Nvidia's stock movements are likely to influence other significant players in the tech sector, including giants like Apple and

, which currently benefit from the AI surge.

The Bigger Picture: The AI Landscape

Nvidia's performance is emblematic of a larger trend in AI investments. As many companies ramp up their AI capabilities, Nvidia remains at the forefront, providing the essential hardware required to turn ambitious AI projects into reality. Even companies whose core business isn't AI, such as Adobe and SAP, are indirectly affected by Nvidia's success—highlighting the chipmaker's outsized influence on the tech industry.

However, challenges loom. Nvidia must navigate investor questions regarding the monetization of AI investments. While companies are pouring money into AI technologies, they must also produce tangible returns on these initiatives. As such, Nvidia's capability to maintain its impressive growth trajectory will be scrutinized closely.

Nvidia's Leadership and Future Potential

As the company edges closer to unveiling its results, there are heightened expectations regarding its next-generation AI chip, Blackwell. Although initial timelines for its release have faced potential delays, the technology promises to significantly outperform existing solutions. Should this product launch proceed smoothly, it could solidify Nvidia's role as a market leader for years to come.

Indeed, the stock’s trajectory has already been impressive, soaring over 160% in value year-to-date. Analysts remain optimistic, projecting EPS growth to potentially reach $2.73 by 2025. This reflection of growth within the tech sector showcases Nvidia as not only a player but a crucial driver of innovation and economic momentum.

Looking Ahead

As investors await news from Nvidia, it’s clear that the company has transformed into a bellwether for the tech market. The upcoming earnings report holds the potential to send shockwaves across the entire market landscape. Positive surprises could ignite renewed investor confidence and potentially drive the

further; conversely, disappointing results could dampen the nascent recovery.

In this climate of cautious optimism, the narrative surrounding Nvidia will inevitably shape the future direction of technology investments. As we anticipate the market's reaction, let’s remember—more than just numbers, these earnings encapsulate a period of unprecedented change driven by AI innovation.