Mexican Peso Declines Amid Judicial Reform Concerns

Explore how proposed judicial reforms are impacting the Mexican Peso, investor confidence, and the country's economic stability during these turbulent times.

Key Points

- The Mexican Peso has depreciated significantly due to concerns over proposed judicial reforms that could undermine judicial independence and investor confidence.

- External factors, including U.S. economic indicators and geopolitical tensions, further exacerbate the peso's volatility in the currency market.

- Political dynamics and reactions from business chambers indicate potential risks to Mexico's investment climate, raising questions about the future economic stability.

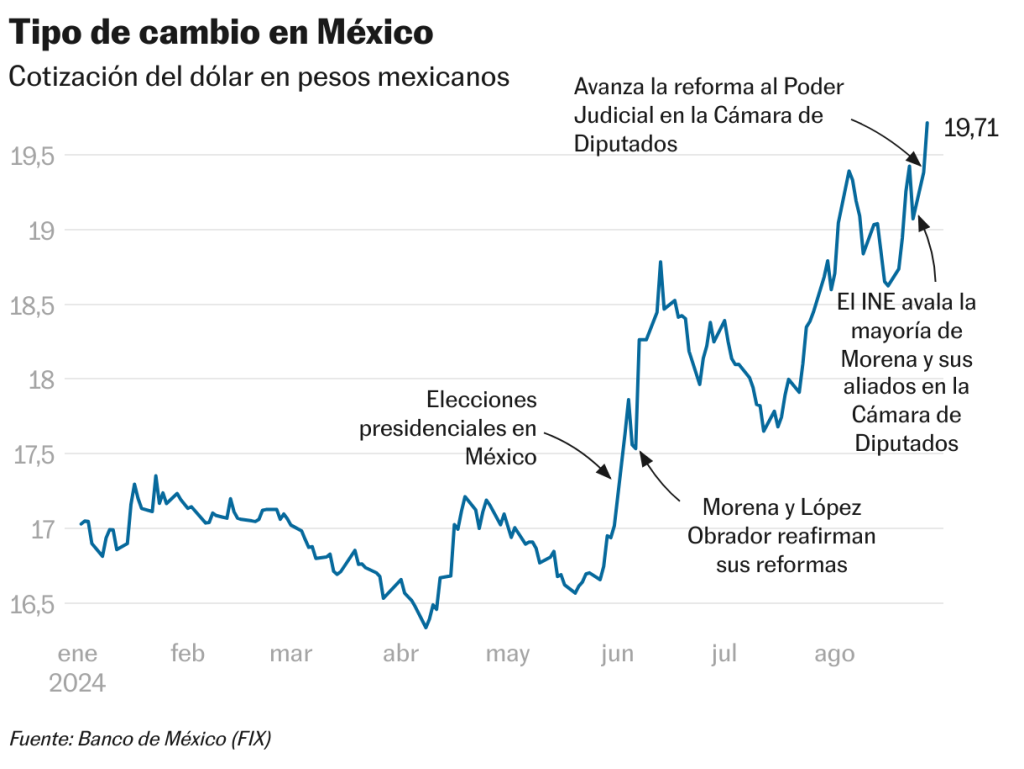

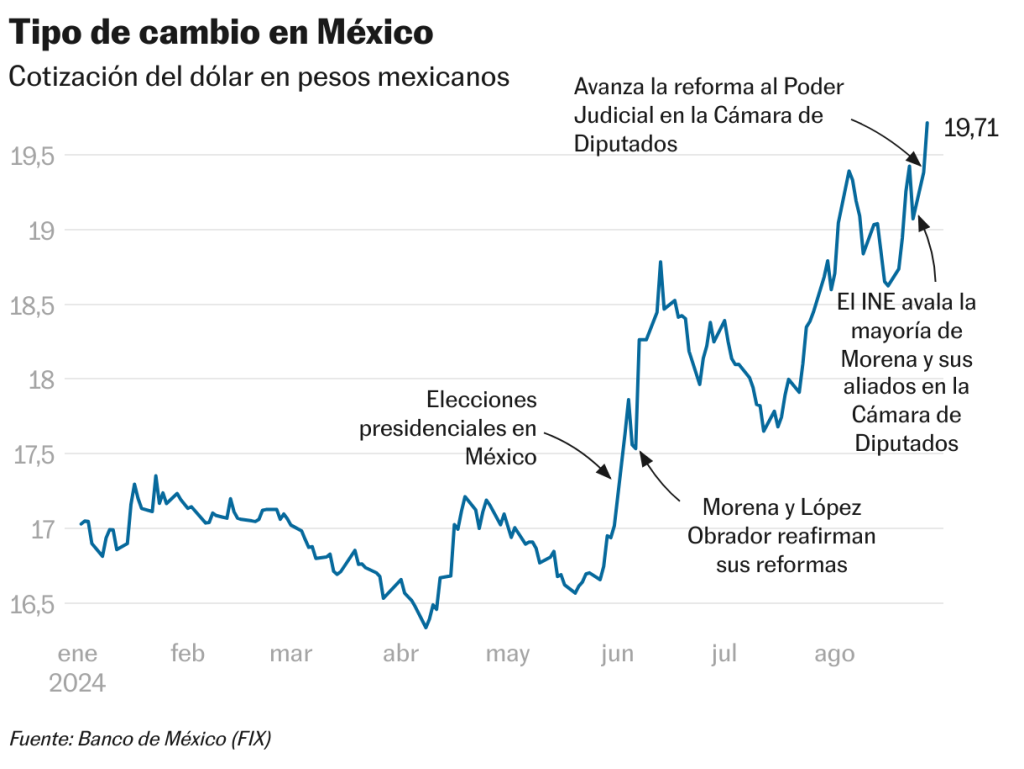

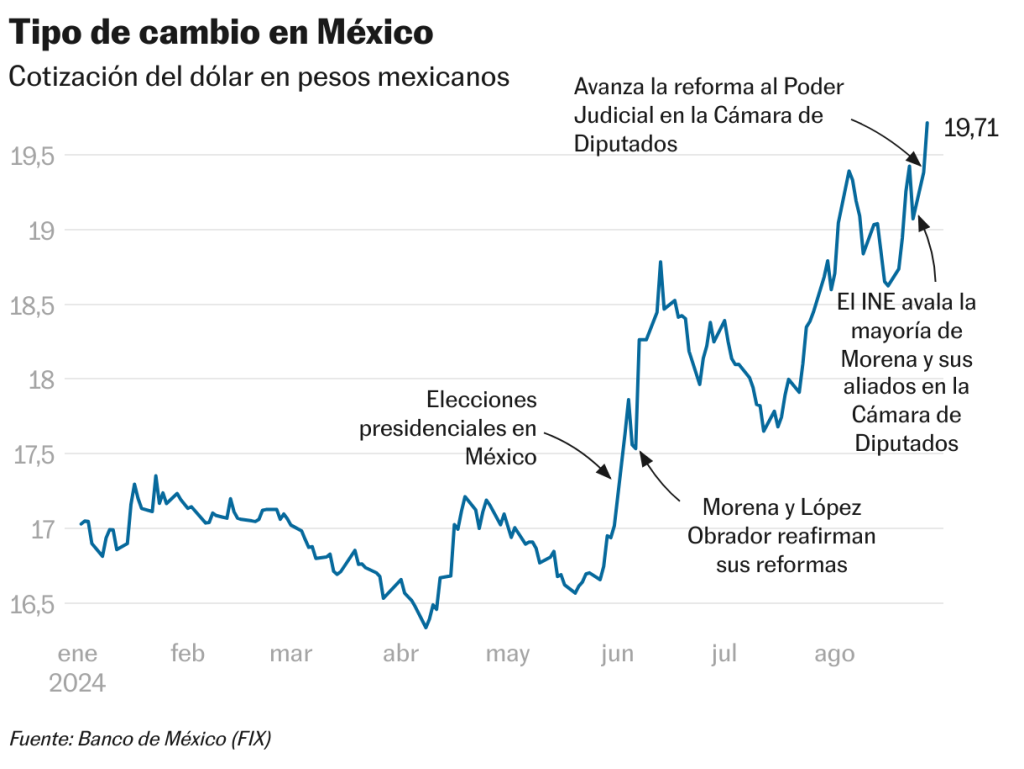

The Mexican Peso has recently faced significant depreciation against the US dollar, marking a period of economic turbulence that is shaking investor confidence. On August 27, 2023, the exchange rate reached alarming levels, hitting 19.76 pesos per dollar. This downward trend was particularly stark following legislative actions that have raised concerns about potential reforms to the Mexican judicial system. As these developments unfold, it is crucial to understand the underlying factors at play and their implications for both the domestic economy and international relations.

The Impact of Judicial Reform Proposals

Recently, a controversial judicial reform proposal was approved by a congressional committee, sparking fears among investors and economists alike. This reform aims to alter the way judges and magistrates are appointed, proposing that these positions be filled through popular votes rather than by appointment. Such changes have raised alarm bells about the independence of the judiciary, which is seen as a vital counterbalance to presidential power.

Financial analysts have expressed a deeply rooted concern that these reforms could lead to decreased foreign investment in Mexico. Gabriela Siller, director at Grupo Base, cautioned that these reforms could push the economy towards recession, negatively affecting both new and existing businesses. With the peso already depreciating significantly since the elections in June—about 16%—the pressure is mounting.

Market Reactions and Global Context

The depreciation of the peso is occurring within a broader context of global economic uncertainty. As the dollar strengthens globally, the peso has struggled to maintain its value. On August 27, 2023, the peso recorded a loss of around 1.83% against the dollar, demonstrating how external factors compound the already domestic troubles stemming from political reforms.

Economic indicators from the United States, such as consumer inflation, play a significant role in the performance of the peso. Investors are closely monitoring the U.S. economy, and any adverse data could amplify the existing volatility in the Mexican market. In a world where currency markets are closely interconnected, the health of the U.S. economy has immediate implications for Mexico.

The Influence of Political Dynamics

The political landscape is another critical aspect influencing the peso's performance. The government, led by President

, has faced skepticism from investors both domestically and internationally due to comments perceived as dismissive of valid concerns about the proposed reforms. Recent statements indicated a "pause" in diplomatic relations with the United States, causing further unease among investors.

Moreover, the reactions of business chambers and political opposition signal a significant pushback against these changes. The American Chamber of Commerce in Mexico and the

have called for a thorough evaluation of these reforms. Their caution reflects growing worries about the potential for detrimental effects on the investment climate in Mexico.

What Lies Ahead for the Peso and Mexican Economy?

Looking forward, many analysts warn that the peso could continue to face downward pressure as the new Congress prepares to take action on the judicial reforms. Expectations are that the exchange rate could further deteriorate, with some forecasts suggesting it may breach 20 pesos per dollar. The uncertainty coupled with upcoming elections in the United States adds another layer of complexity and potential volatility in the currency market.

As the political and economic scenarios evolve, it is crucial for investors, policymakers, and average citizens to remain informed and engaged. Vigilance in monitoring these developments can provide insights into the potential outcomes and their broader implications for Mexico's economy.

The depreciation of the Mexican peso amid proposed judicial reforms raises essential questions about the future of governance and economic stability in Mexico. While external factors heavily influence the peso's value, internal political decisions play a pivotal role as well. As the nation navigates these turbulent waters, it is imperative for all stakeholders to engage in constructive dialogue and focus on building a resilient economic framework that ensures investor confidence and strengthens democratic institutions.