Hyundai Motor India's IPO Challenges and Future Potential

Explore Hyundai Motor India's IPO journey, highlighting investor hesitancy and the potential for future growth in a changing automotive market.

Key Points

- Hyundai Motor India

's IPO, the largest in the country to date, faced significant investor hesitancy due to high valuations and market uncertainties.

- Institutional investors showed strong interest, while retail participation was lukewarm, indicating concerns about future gains amidst slowing auto sales.

- The company's commitment to expand its production capabilities and introduce EV models signals a promising long-term strategy in a growing market.

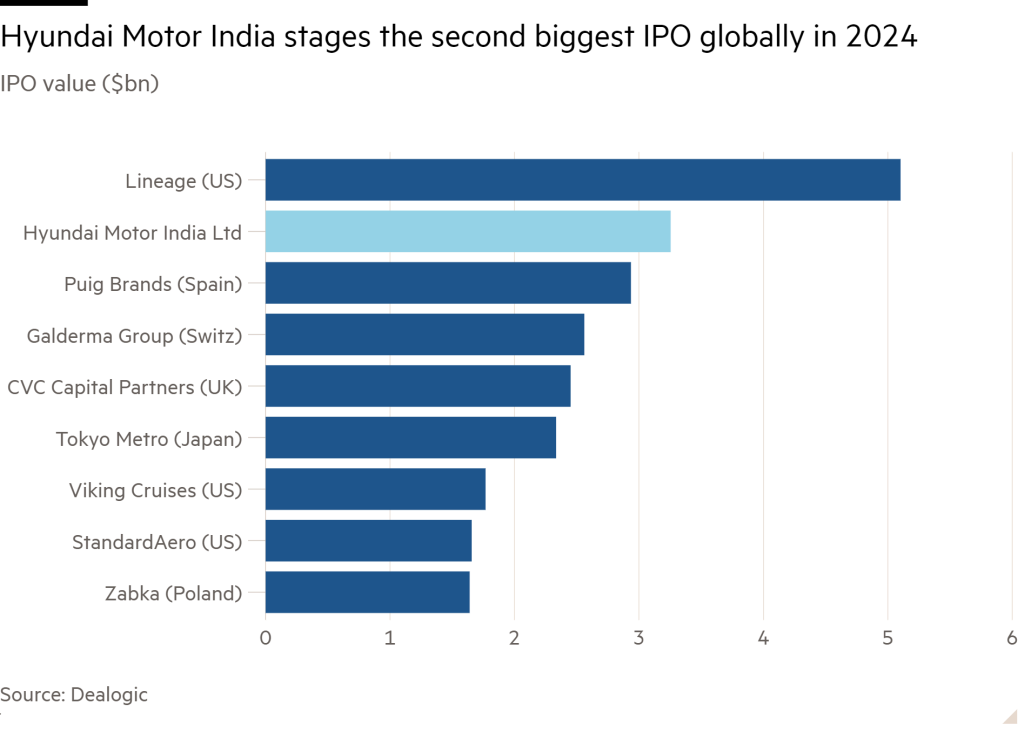

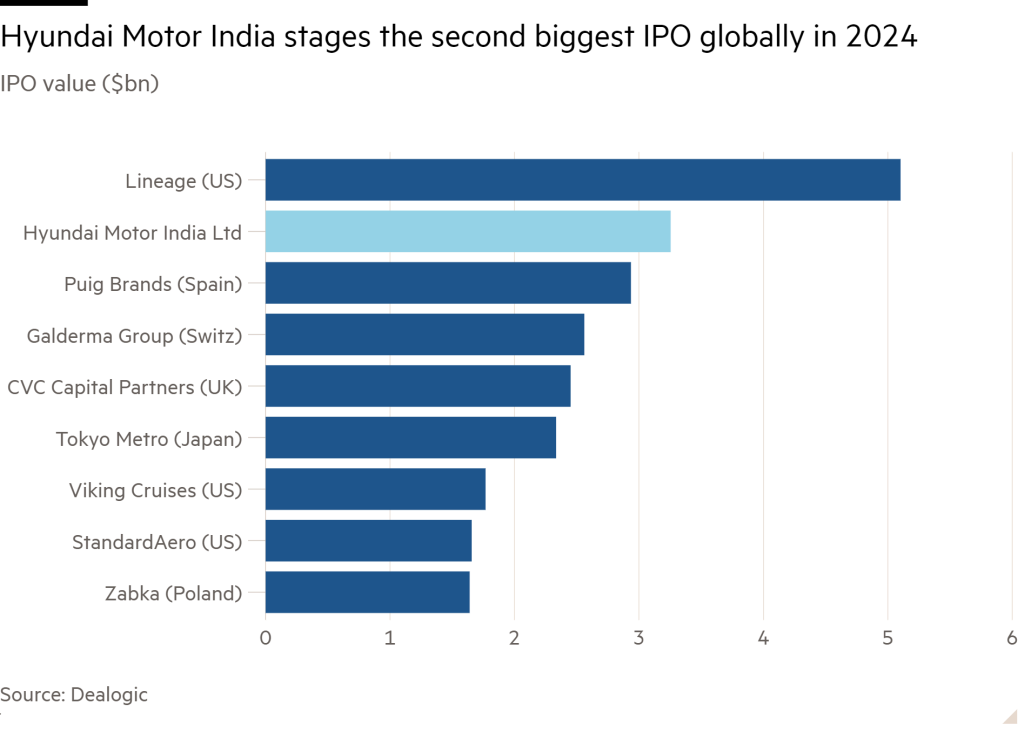

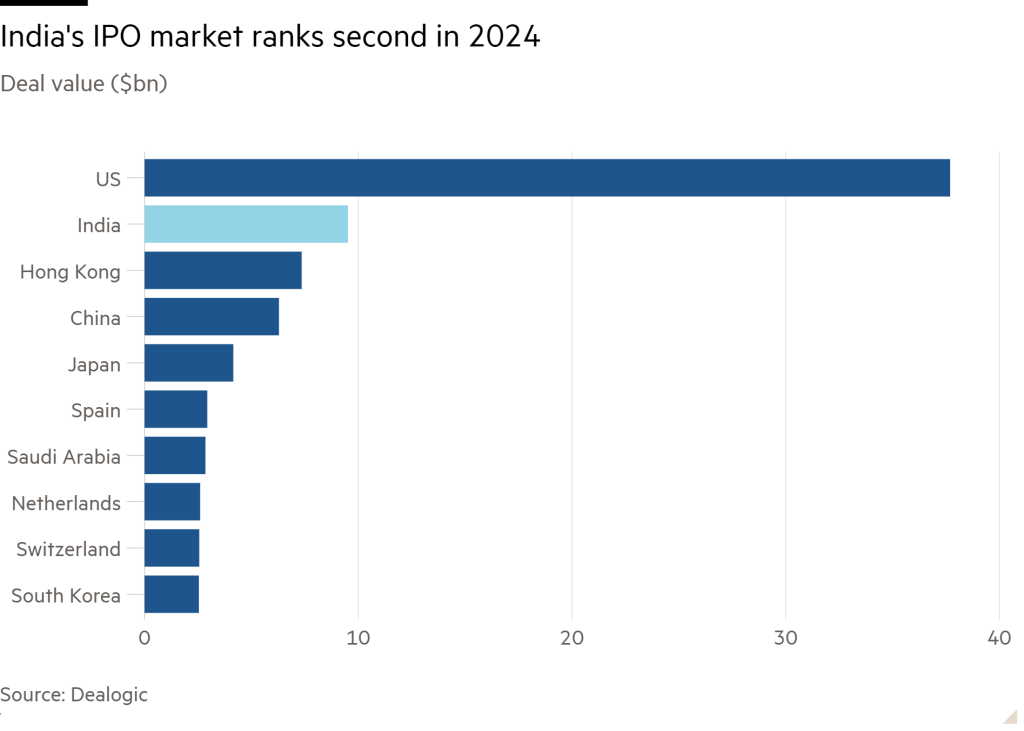

In a significant moment for both Hyundai Motor India and the Indian stock market, the company recently launched its initial public offering (IPO), raising an impressive $3.3 billion. This endeavor, marking the largest IPO in India's history, also represents a pivotal moment for the automotive sector in a rapidly evolving economic landscape. However, despite the potential, the market response has revealed challenges that both investors and the auto industry must navigate thoughtfully.

Hyundai Motor India, the nation’s second-largest carmaker, experienced a rocky start on the

stock exchange, with shares slipping from their issue price of 1,960 rupees to as low as 1,820 rupees shortly after debuting. This decline signals more than just initial investor reluctance; it reflects a broader sentiment among retail investors about valuation and market conditions.

The Driving Factors Behind Investor Hesitation

Several factors have contributed to the lukewarm reception of Hyundai's IPO. Firstly, the valuation concerned many retail investors. At about 26 times its fiscal 2024 earnings, Hyundai's pricing appeared steep, particularly against market leader

, which trades at a higher valuation but offers a much larger market cap. This raises continuous questions about growth prospects and immediate gains.

Moreover, the overall market trend has not favored automotive stocks lately. Analysts report that urban consumer sentiment has dipped, impacting vehicle sales and consequently affecting investor confidence. With September witnessing a 9% drop in retail vehicle sales, fears of inventory pile-ups and declining demand have further clouded the outlook for new entrants like Hyundai.

Institutional vs. Retail Investor Interest

Interestingly, while the IPO was oversubscribed more than two times, most of this demand came from institutional investors rather than retail participants. Retail investors only claimed about 50% of the portion reserved for them. This disparity speaks volumes about their cautious approach amid economic uncertainties and concerns over the company's pricing strategy.

Institutions such as

’s government fund and notable investment firms like

and Fidelity have shown a robust appetite for Hyundai, suggesting that they see potential value in the long term. Analysts from major brokerages like Nomura even initiated coverage with a 'buy' rating, citing healthy volume growth expectations and Hyundai's strategic pivot to a larger SUV portfolio in the Indian market.

Looking Towards the Future

Despite the shaky debut on the stock exchanges, there is a narrative of optimism surrounding Hyundai Motor India's future. The company plans to channel IPO proceeds into critical areas such as expanding production capabilities and enhancing its electric vehicle (EV) lineup—a sector poised for growth as India's automotive landscape modernizes. Hyundai's ambition to introduce four new EV models is particularly noteworthy, especially as more consumers gravitate towards sustainable transportation options.

Moreover, as a formidable player leveraging India's expanding middle class and rapidly growing market, Hyundai holds a competitive edge. The Indian car market is projected to reach 20 million units by 2047, positioning Hyundai favorably if it can navigate these early challenges effectively.

The IPO not only marks a significant step in Hyundai's strategic pursuits but also presents a crucial learning moment for investors and industry analysts. With dynamics of valuation and broader economic sentiments at play, this could undoubtedly shape the IPO landscape in India. Investors who remain cautiously optimistic and venture beyond immediate returns may find future opportunities within such dynamically evolving markets.

In summary, Hyundai Motor India's IPO journey highlights critical challenges and opportunities within the automotive industry in India. Despite a rough start marked by retail investor hesitation, the long-term outlook seems promising depending on the company's strategic decisions and market recovery trends. As the automotive sector continues to evolve, this landmark moment serves as a focal point for both investors and the industry in understanding the delicate balance of market dynamics, consumer behavior, and corporate growth strategies.