Deposit Rate Cuts Transform Savings and Borrowing in Europe

Explore how the ECB's deposit rate cuts reshape savings and borrowing, fostering economic growth while navigating inflation challenges across Europe.

Key Points

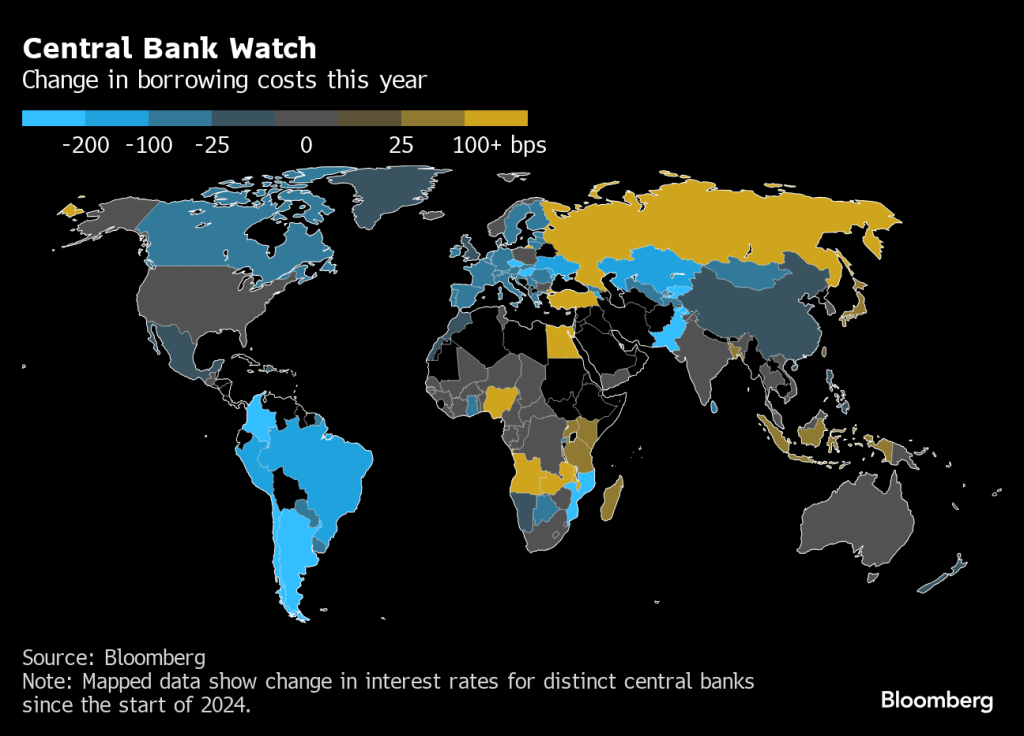

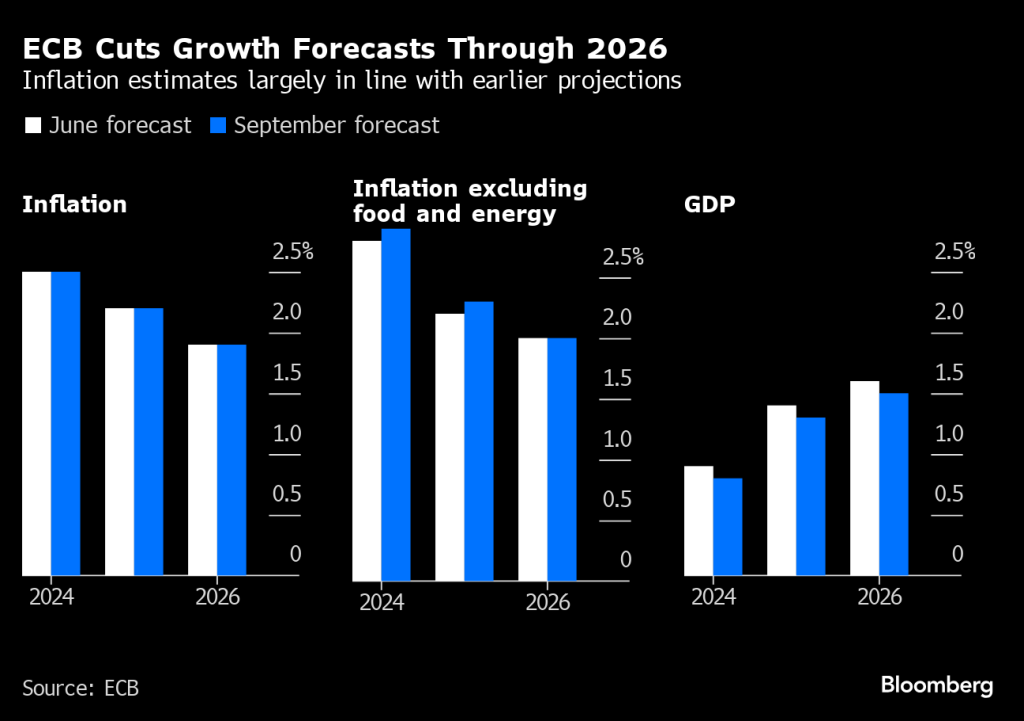

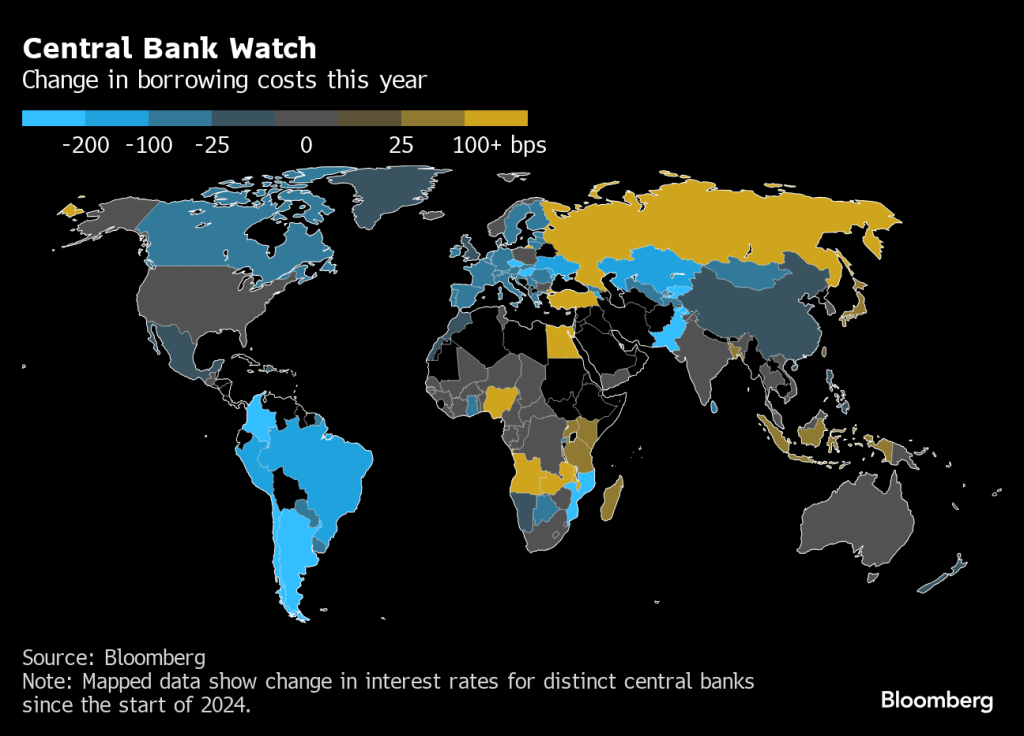

- The ECB has cut the deposit rate to 3.50% to stimulate economic growth as inflation approaches its target.

- Lower interest rates may encourage spending and investment but could reduce yields for savers reliant on interest income.

- The bank's future rate decisions will be based on economic data, emphasizing a cautious, flexible approach to monetary policy.

The

(ECB) has recently made headlines by cutting its deposit rate to 3.50%, following a similar reduction earlier in June. This move comes in the wake of a slowing economy and easing inflation, signaling a potential new era for savers and borrowers alike. As the financial landscape begins to shift, it is essential to understand the implications of these changes for individuals and businesses. In this blog post, we will explore the reasons behind the ECB's decision, what it means for savers, and the outlook for the coming months.

Understanding the Context of the Cuts

The decision to lower the deposit rate stems from a need to stimulate economic growth as inflation cools down. According to recent data, the inflation rate in the

has decreased to approximately 2.2%, which is close to the ECB's target of 2%. This reduction in inflation, influenced by falling global prices, allows the ECB to shift its focus from combating inflation to fostering economic growth. The ECB's proactive approach demonstrates its commitment to addressing economic stagnation in the Eurozone.

Impacts on Savers and Borrowers

For savers, lower deposit rates might initially seem disadvantageous. However, this environment encourages institutions to provide more favorable borrowing conditions, potentially making loans and mortgages more accessible. When borrowing costs are lower, it stimulates spending and investment, which can ultimately benefit savers in the long run through economic growth. On the flip side, those relying on interest income from savings may need to adjust their financial strategies since the inherent yield will likely decrease.

Moreover, as the banking sector adapts to this policy shift, we may witness an increase in various loan types. For instance, variable-rate loans are expected to become more favorable as financial institutions respond to lower deposit rates. As consumer demand for loans rises, banks might begin innovating new financial products that offer better interest rates for borrowers, encouraging economic activity.

What Lies Ahead

The ECB’s current monetary policy has sparked discussions among financial analysts regarding potential future cuts. While some anticipate further adjustments by December, the exact trajectory remains uncertain, largely dependent on economic indicators in the coming months. This uncertainty emphasizes the importance of a data-driven approach to decision-making by the ECB, allowing flexibility to respond to changing economic conditions.

Interestingly, diverging opinions among policymakers present a broader conversation about the state of the eurozone economy. Some more dovish members express concerns about rising recession risks, highlighting that current high interest rates may be stymying growth beyond what is necessary. Conversely, inflation-minded hawks maintain that underlying market signals — especially from the labor market — do not justify a more aggressive easing of interest rates.

A New Era for Economic Strategy

The cut in the deposit rate is not merely a technical adjustment; it signals a strategic pivot by the ECB in handling a gradually evolving economic landscape. This proactive approach could allow for a more robust economic recovery, positioning the eurozone to navigate uncertainties more effectively. As ECB President

emphasized, the bank remains focused on a meeting-by-meeting assessment approach, ensuring that future policy actions align closely with economic indicators.

As this new monetary policy era unfolds, both savers and borrowers should stay vigilant. Understanding the broader implications of the ECB’s decisions will help individuals and businesses make informed financial choices. It encourages flexibility in adapting to the changing economic environment, maximizing benefits from potentially emerging lending opportunities.

The ECB’s recent deposit rate cut marks a critical juncture for the eurozone economy. As the landscape continues to evolve, staying informed and agile will be key for judicious financial management. Ultimately, while challenges remain, the prospects created by these changes could lead to exciting developments in Europe’s economic recovery trajectory.