Bank of England Holds Interest Rates Amid Inflation Rise

Explore how the Bank of England’s decision to maintain interest rates affects borrowers and influences the UK economy amid rising inflation.

Key Points

- The Bank of England

has decided to keep interest rates at 4.75% to combat rising inflation now at 2.6%, above the target.

- Concerns about a sluggish economy and the impact of taxation increases have prompted cautious forecasts for future rate cuts.

- The delicate balance between curbing inflation and fostering economic growth remains central to the BoE's monetary policy strategy.

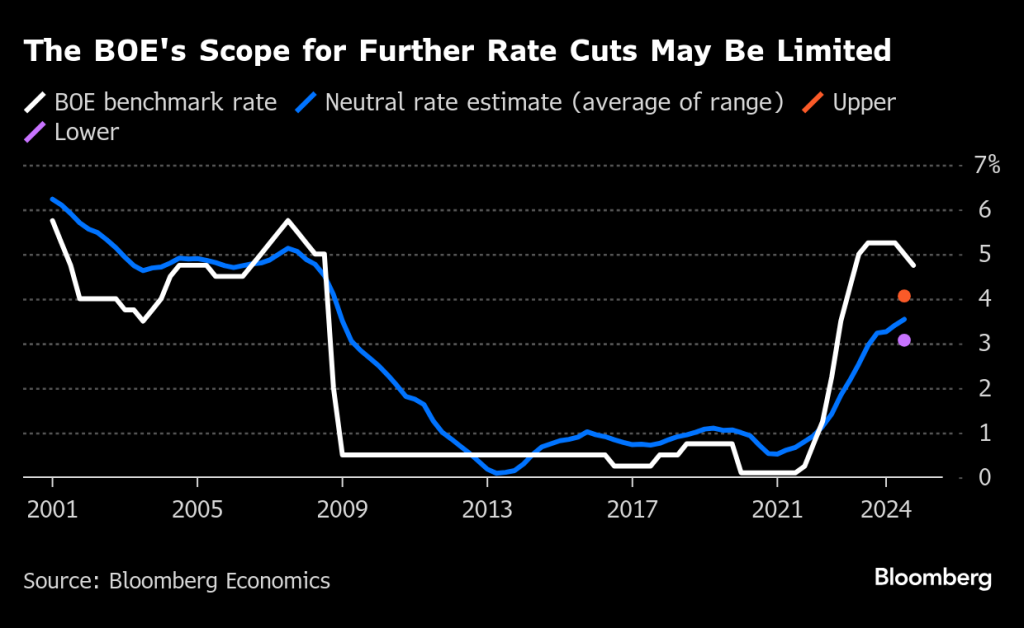

The Bank of England (BoE) has recently decided to keep interest rates steady at 4.75% amid rising inflation concerns, marking a significant moment for borrowers and investors alike. This decision was reached by the Monetary Policy Committee (MPC), which voted six to three to hold rates, reflecting a cautious approach to managing lingering inflationary pressures that have gripped the economy.

Understanding the Inflation Context

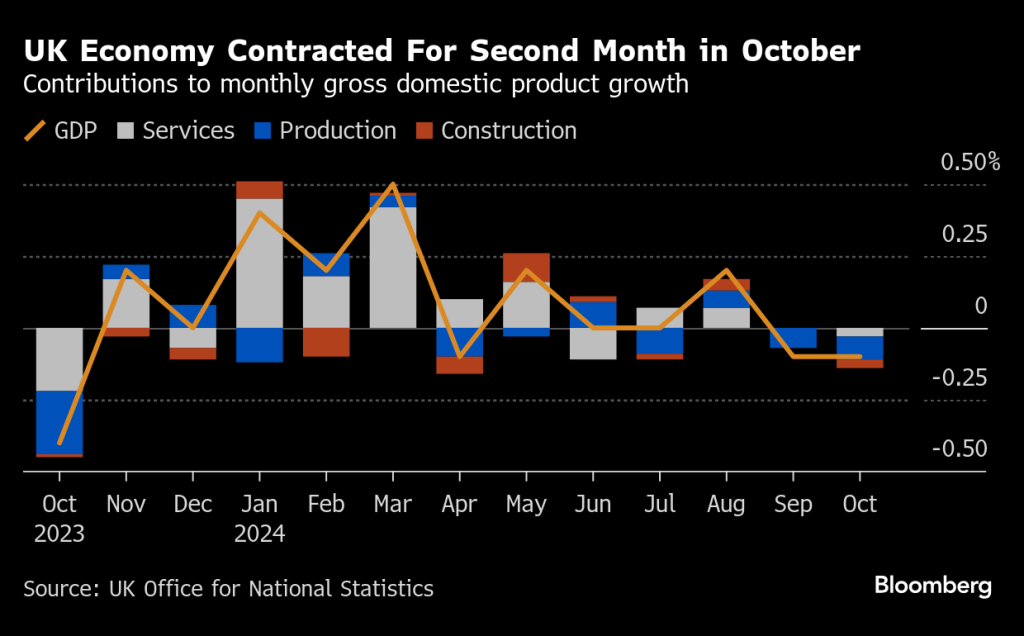

Inflation rates in the UK have climbed to 2.6%, a rise from 2.3% the previous month, which is notably above the BoE's 2% target. These statistics have stirred concerns within the Bank regarding how inflation, particularly in the services sector, could continue to dictate economic policy. The situation is compounded by a sluggish economy, which has seen contractions over consecutive months.

The Cautious Approach of the BoE

Despite calls for rate cuts from various sectors impacted by economic stagnation, the BoE has chosen to maintain a cautious stance. This decision echoes the sentiment of many economists, who predict that rate cuts in the future will be slow and gradual. For example, while some markets had anticipated up to four cuts in 2025, expectations have since been dialed back to just two, illustrating a significant change in investor sentiment.

The Implications for Borrowers and Businesses

The implications of holding interest rates at this level extend far beyond just borrowers. Businesses, faced with higher borrowing costs, may be reluctant to invest or expand, potentially leading to job cuts and reduced economic activity. This indicates a delicate balance that the BoE must maintain; while controlling inflation is essential, stifling business growth is equally concerning.

Future Predictions and Economic Indicators

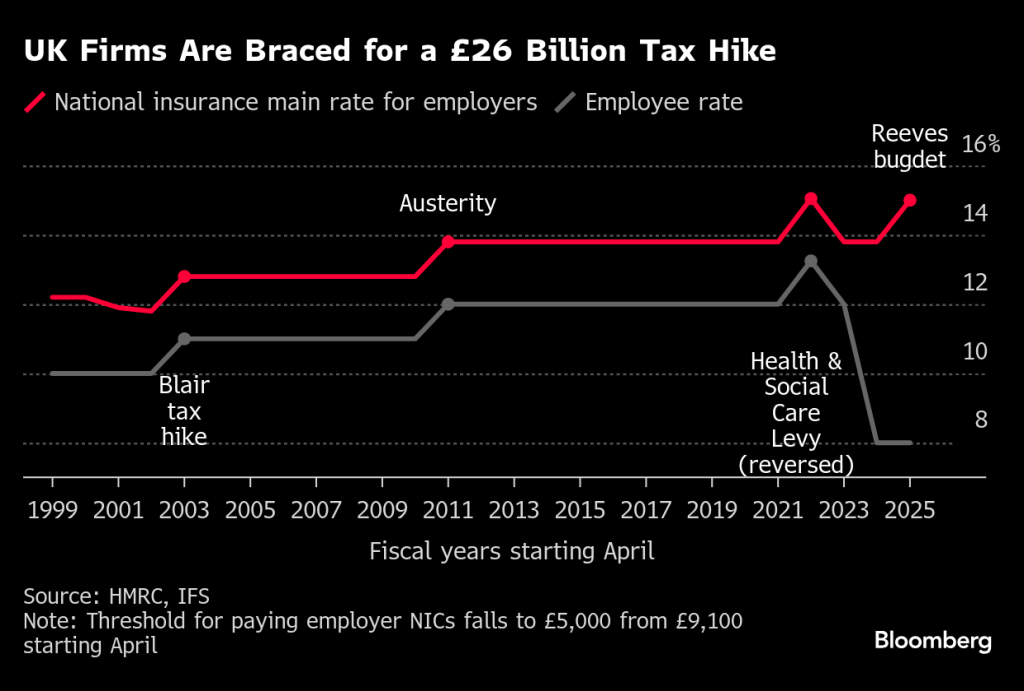

Looking ahead, the economic landscape is uncertain. The Chancellor’s recent budget, which included tax increases, has added to the inflationary pressures, leaving many economists wary about the future. The reaction of businesses to these tax changes remains a point of concern; increased payroll costs could lead to either higher consumer prices or restrained hiring practices.

Global Perspectives on Monetary Policy

The UK is not alone in grappling with these issues. The

in the US has also adopted a more cautious approach with its recent rate cuts. There are growing concerns that ongoing inflation and sluggish growth could be a recurring theme across developed economies. The interplay between national monetary policies and global economic conditions will be critical in shaping the path forward for interest rates.

As the Bank of England continues to navigate these turbulent economic waters, the balance between curbing inflation and fostering economic growth remains central to its strategy. The decisions made in the coming months will likely have long-lasting effects, not just on immediate borrower costs but on the overall economic landscape of the UK.

Looking Ahead

In summary, while the decision to keep interest rates stable may not provide immediate relief for borrowers, it underscores the BoE's commitment to tackling persistent inflation. The economic indicators will be closely monitored as businesses and consumers alike brace for the impact of these decisions on their financial futures. Thus, understanding these broader economic dynamics will be invaluable as we move forward.