August Jobs Report Insights and Its Impact on the Fed

Discover how the August jobs report will influence Federal Reserve interest rate decisions and reflect the resilience of the U.S. labor market.

Key Points

- The August jobs report is expected to show a modest increase of around 160,000 jobs, reflecting a cooling labor market.

- The Federal Reserve

is likely to consider a rate cut in September, influenced by the outcomes of the jobs report and inflation data.

- Market reactions will hinge on the report's implications for economic stability and the evolving dynamics within the job market, particularly in tech sectors.

The August jobs report, released by the

(BLS), serves as a crucial indicator of the U.S. economy's health and direction. As the Federal Reserve prepares for its next monetary policy meeting on September 18, this report is highly anticipated—regarded as potentially pivotal in shaping the central bank's future actions regarding interest rates. Both economists and investors are watching closely, and this report might just deliver the insights they need.

What the Data Reveals

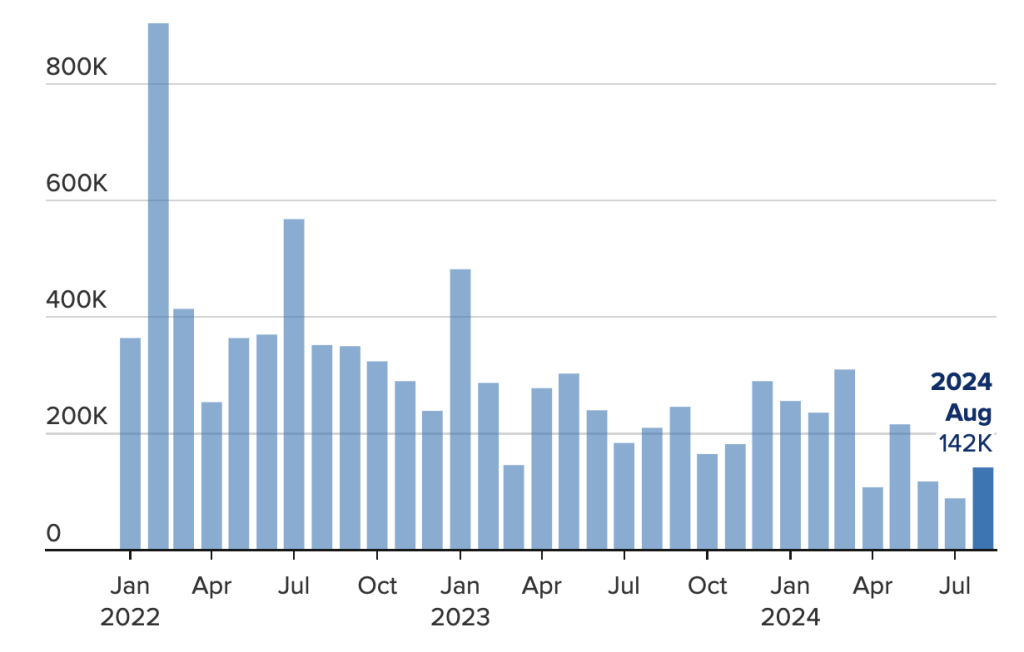

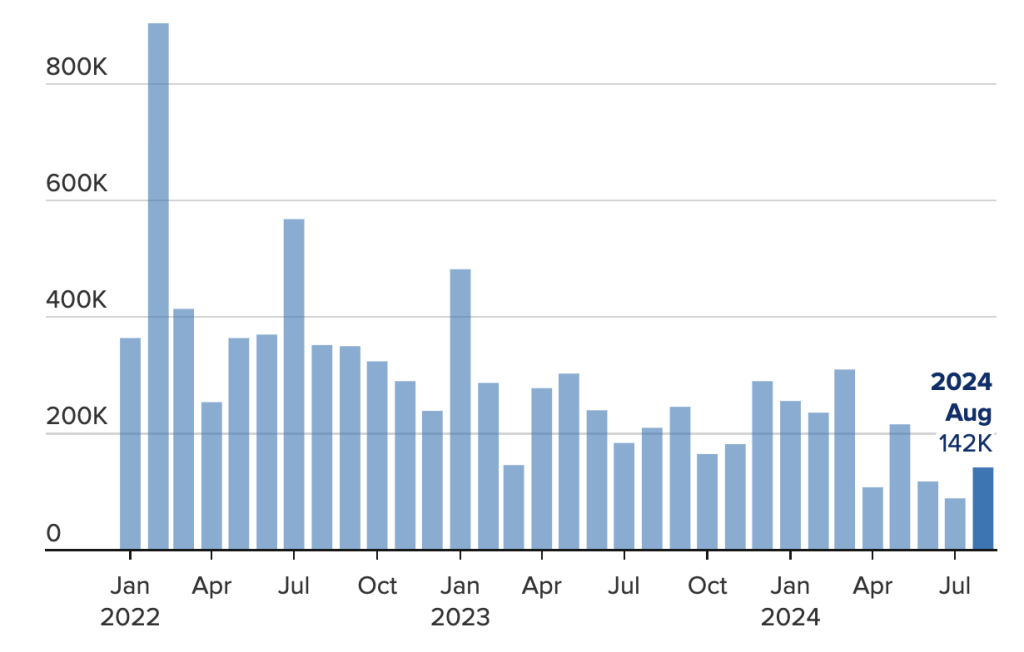

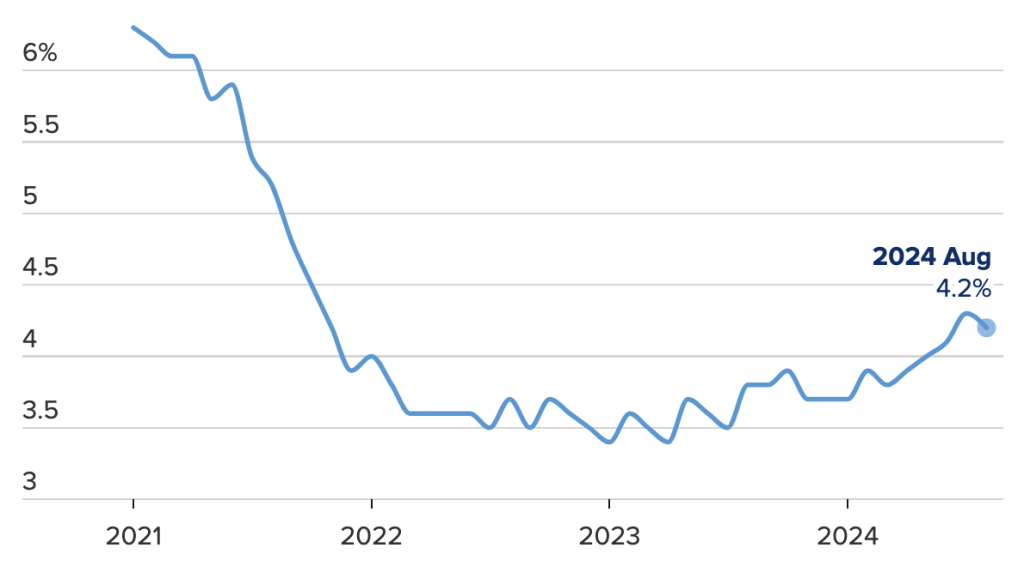

The consensus estimates suggest that the U.S. economy added around 160,000 jobs in August, a modest increase compared to the 114,000 jobs added in July. While this growth is a positive signal, it is important to note that the overall pace of job creation has significantly cooled, with July’s figures representing a notable downturn from earlier months. The unemployment rate is expected to dip slightly to 4.2%, from July's 4.3%, which was the highest unemployment rate in three years. This indicates a cautious but optimistic outlook.

However, the rise in the unemployment rate is not strictly negative. Much of it reflects an influx of new job seekers, including recent graduates and immigrants, indicating a healthy movement back into the labor market. Observers suggest that this influx means a broadening labor force rather than outright deterioration in job availability. Labor force participation remains steady, which signals a resilient demand for workers.

The Fed's Dilemma

The Federal Reserve is in a position where they must carefully weigh these employment figures against inflation data as they deliberate on the timing and magnitude of interest rate cuts. The central bank has signaled a shift in focus from fighting inflation to supporting a healthy job market. Given that inflation rates have mellowed, the Fed is poised to consider a reduction in the current benchmark interest rate, with forecasts leaning towards a 0.25% to 0.50% cut in the upcoming meeting.

Market expectations balance precariously around this potential cut, with the

showing a split between a 41% chance of a 0.50% cut and a 59% likelihood for a 0.25% adjustment. The nature of the August jobs report will likely influence these probabilities. A disappointing report may push the central bank towards a more aggressive cut, while stronger data could lead to a more tempered approach.

Market Reactions and Future Forecasts

The implications of the August jobs report extend beyond just the Federal Reserve's decisions; they also influence market sentiment and investor strategies. If the report signals economic resilience, it may encourage investments in equities, thereby pushing stock prices higher. Conversely, a weak report would likely heighten fears of a recession and trigger a sell-off in equities.

A further consideration is the ongoing transition in the job market itself, especially in sectors heavily impacted by technology. The tech industry has seen significant job cuts recently, with over 39,000 announced layoffs solely attributed to automation and artificial intelligence advancements. Such changes underline the evolving landscape of employment and may face opposition from workers who express concerns over job security.

Looking Ahead

Ultimately, the August jobs report is a telling barometer of the economy's current state. Beyond merely analyzing numbers, it’s vital to understand the context—economic shifts, job sector dynamics, and consumer confidence all play crucial roles. The balance between promoting growth while containing inflation is a tightrope the Fed must navigate effectively.

As we await the final numbers, it's paramount to maintain a sense of optimism and preparedness. The labor market may be transforming, but the underlying fundamentals suggest resilience. The outcomes of this report will not only affect monetary policy but also the broader landscape of American economic potential and workforce stability.