Navigating Inflation and Interest Rates for Economic Stability

Discover how the Bank of England balances interest rates and inflation to ensure economic stability amid ongoing financial challenges.

Key Points

- The Bank of England

maintains interest rates at 5% to navigate persistent inflation while balancing economic growth.

- Current inflation levels remain above the Bank's target, prompting a cautious approach to any potential rate cuts in the future.

- Both borrowers and savers are affected by this monetary policy, with future cuts anticipated if inflation trends continue to improve.

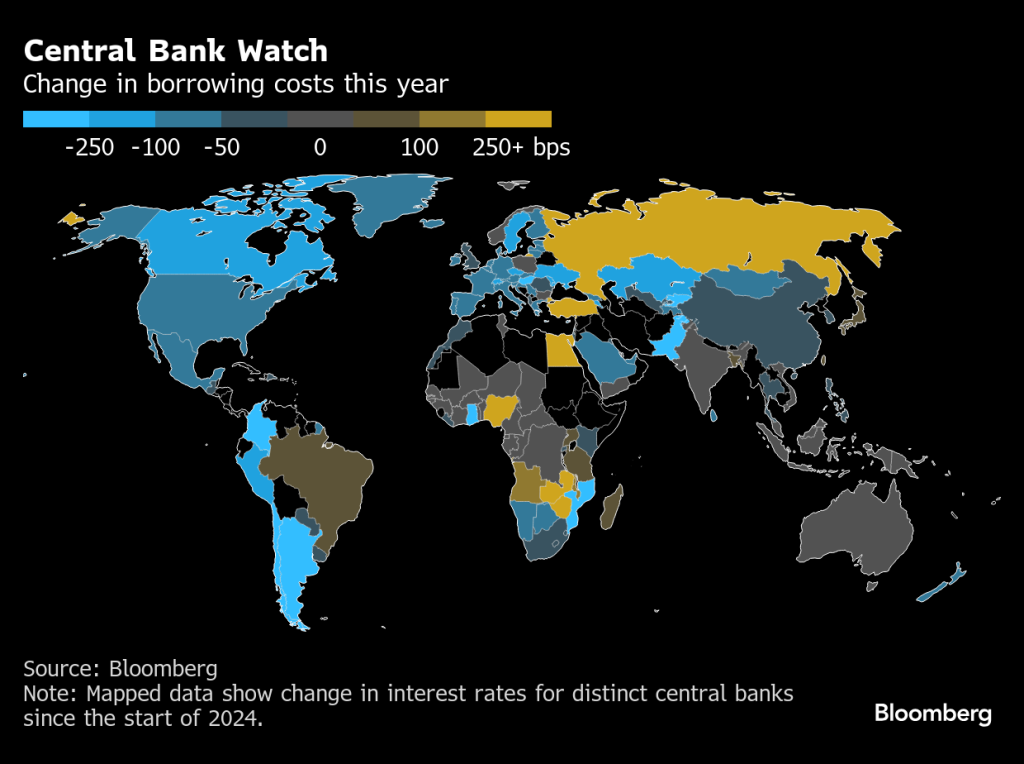

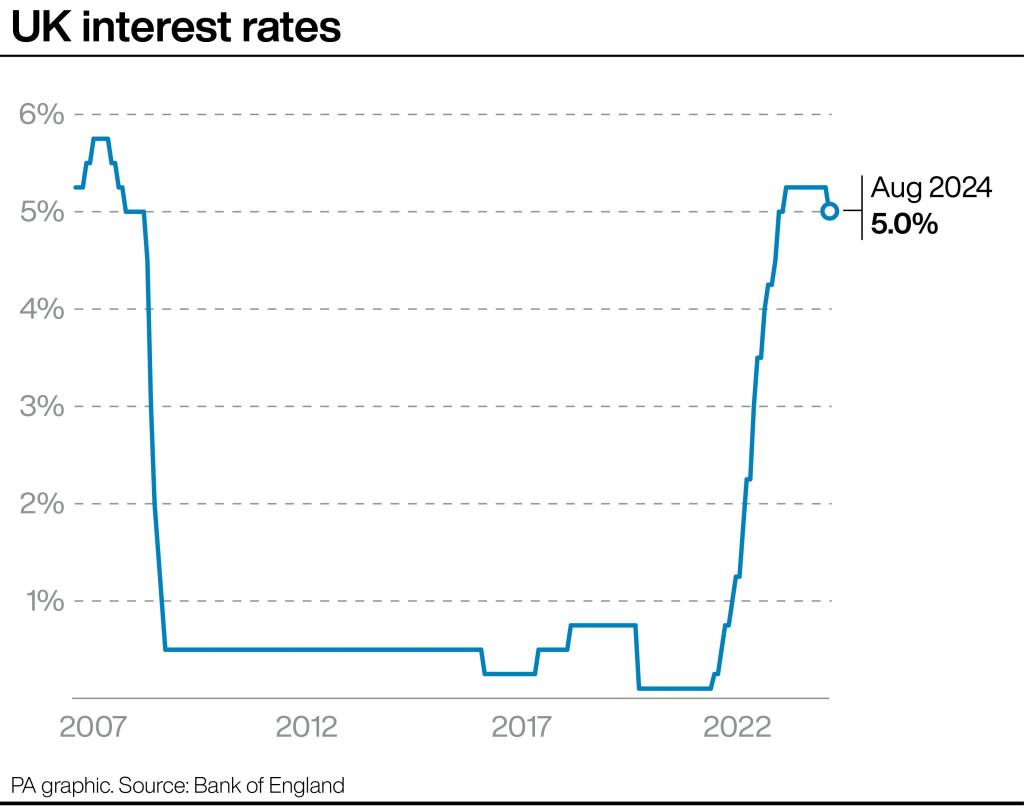

As central banks around the world recalibrate their monetary policies to respond to persistent inflationary pressures, the Bank of England faces a critical juncture. In recent meetings, the Monetary Policy Committee (MPC) has opted to maintain interest rates at 5%, focusing on a careful balance between stimulating economic growth and ensuring price stability. Understanding these dynamics is essential for businesses, consumers, and policymakers alike as they navigate this complex economic landscape.

The Current Economic Climate

With inflation rates hovering at 2.2% in August, the Bank's decision to keep rates static is a reflection of a broader economic strategy aimed at controlling prices without stifling growth. The last rate cut from 5.25% marked a significant moment, as it was the first reduction since early 2020. However, analysts emphasize that the journey towards achieving the bank’s 2% inflation target remains fraught with challenges.

Sustained inflation levels, particularly in the services sector, which comprises about 80% of the UK economy, indicate a need for a cautious approach. The MPC’s decision to maintain rates has been largely anticipated, driven by economic indicators that suggest both inflation and economic activity are stabilizing.

Inflation Trends and Future Prospects

The most recent data from the

highlights a decade of fluctuating inflation rates; after peaking at over 11% in late 2022, the subsequent decline signifies positive movement towards economic normalization. However, many economists predict that inflation may tick upward again, particularly as factors such as falling energy prices play out in annual comparisons.

The MPC is committed to squeezing out persistent inflationary pressures to aim for lasting stability. This careful, analytical approach underscores not only the complexities of the current economic environment but also the need for strategic decision-making moving forward. While the economy has shown signs of stagnation, a gradual easing of interest rates in the coming months remains on the table, contingent on inflation trends.

The Importance of Strategic Decision-Making

Notably, some voices within the MPC, such as Swati Dhingra, advocate for a more liberal approach, suggesting that inflation trends may indeed warrant quicker rate cuts. The counterarguments rest on the premise that cutting rates too quickly could reignite inflation, negating any prior gains made in controlling prices.

This dialogue within and outside the MPC showcases the delicate balancing act that central banks must perform: fostering economic growth while safeguarding against the pitfalls of rising inflation. Economic forecasts and global developments will undoubtedly influence future rate decisions, making it essential for stakeholders to stay informed and engaged.

The Road Ahead for Borrowers and Savers

For borrowers, the current rate stability provides a temporary reprieve, as they continue to manage financial challenges exacerbated by cost-of-living increases. However, the anticipation of future cuts in November brings a glimmer of hope for those seeking to alleviate their financial burdens.

Savers, on the other hand, face a more complicated scenario. The recent trend towards higher interest rates has benefitted easy-access account holders significantly, with an estimated £4 billion increase in overall savings. Yet, many savers express disappointment as rates remain below pre-pandemic levels, highlighting the need for ongoing adaptations in the banking sector.

The interplay between inflation and interest rates showcases the intricate web of economic factors at play. As the Bank of England navigates this landscape, stakeholders must remain alert to the unfolding developments. By understanding these dynamics and remaining informed, consumers, businesses, and policymakers can better position themselves for the challenges and opportunities that lie ahead.