ECB Cuts Interest Rates to Boost Growth in Eurozone Economy

Explore how the ECB's strategic interest rate cuts aim to stimulate growth and stabilize the Eurozone amid rising inflation and political uncertainty.

Key Points

- The ECB has lowered interest rates to 3% as part of a strategy to stimulate economic growth amid inflation stabilization and political turmoil.

- Lower interest rates aim to encourage borrowing and spending, providing relief for households and businesses amidst looming trade tensions.

- Further rate cuts may occur, positioning the Eurozone

to better compete globally and address its unique economic challenges.

Recently, the European Central Bank (ECB) made headlines with its decision to lower interest rates for the fourth time this year, bringing the benchmark deposit rate down to 3%. This move is part of a broader strategy aimed at addressing the economic challenges facing the Eurozone, particularly in light of persistent inflation concerns and political instability in major economies like France and Germany. In this post, we’ll explore why these cuts are necessary, what they mean for the economy, and how they fit into the larger global economic landscape.

The Rationale Behind the Rate Cuts

The ECB's decision comes amid indications that inflation is stabilizing closer to the desired target of 2%. In fact, recent statistics show that inflation in the Eurozone has decreased to 2.3%, a significant drop from the highs witnessed in late 2022. This presents a unique opportunity for the ECB to pivot its monetary policy's focus toward stimulating economic growth.

Political uncertainty also looms large, particularly with the impending elections in Germany and ongoing leadership challenges in France. These factors have contributed to skepticism regarding the stability of economic recovery in the Eurozone. According to the latest ECB forecasts, growth is expected to be sluggish, with predictions suggesting an increase of only 1.1% in 2025—down from earlier estimates. The economic backdrop is such that many analysts agree that lower interest rates can support business borrowing and investment, which are crucial for recovery.

The Impact of Lower Interest Rates

Lowering interest rates typically encourages spending by making loans more affordable for both individuals and businesses. This is particularly vital given the Eurozone's reliance on exports, which are currently under threat due to potential trade tensions with the United States. Notably, President-elect

's administration has hinted at the possibility of imposing significant tariffs, which could further strain the economies of Eurozone countries that depend heavily on trade.

For households, lower interest rates can lead to reduced mortgage payments, easing the financial burden on families. Recent studies suggest that homeowners with variable-rate mortgages could save an average of 1,500 euros annually due to these rate cuts. This increased disposable income can help stimulate consumer spending, providing a much-needed boost to local economies.

Long-Term Perspectives and Global Outlook

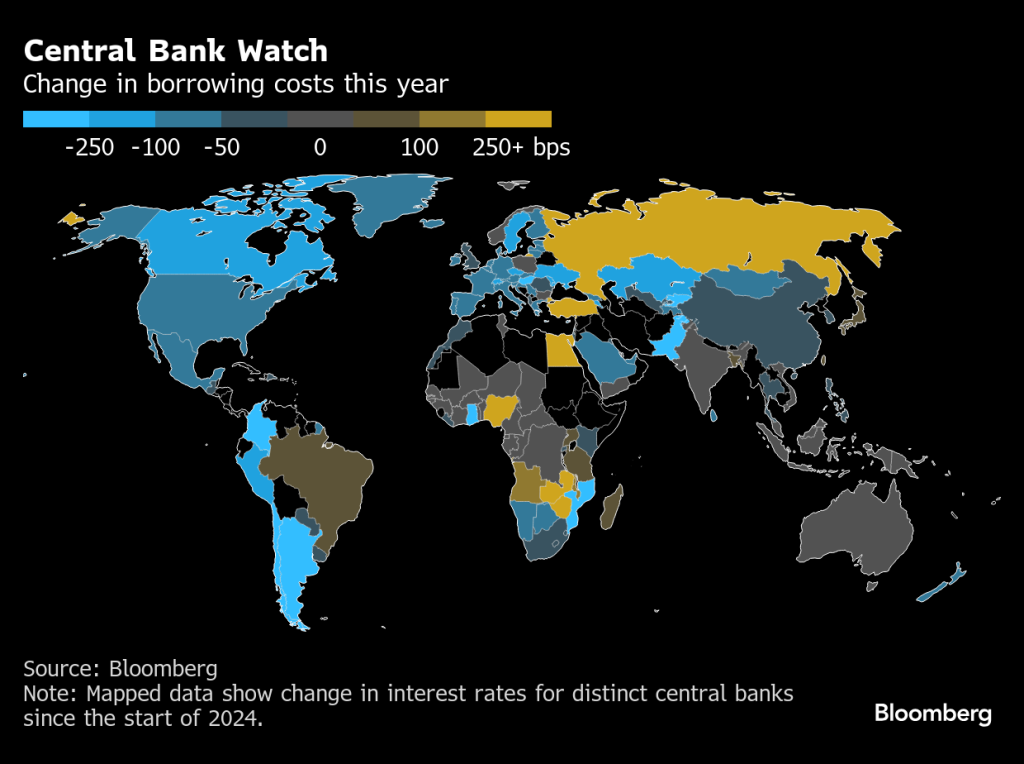

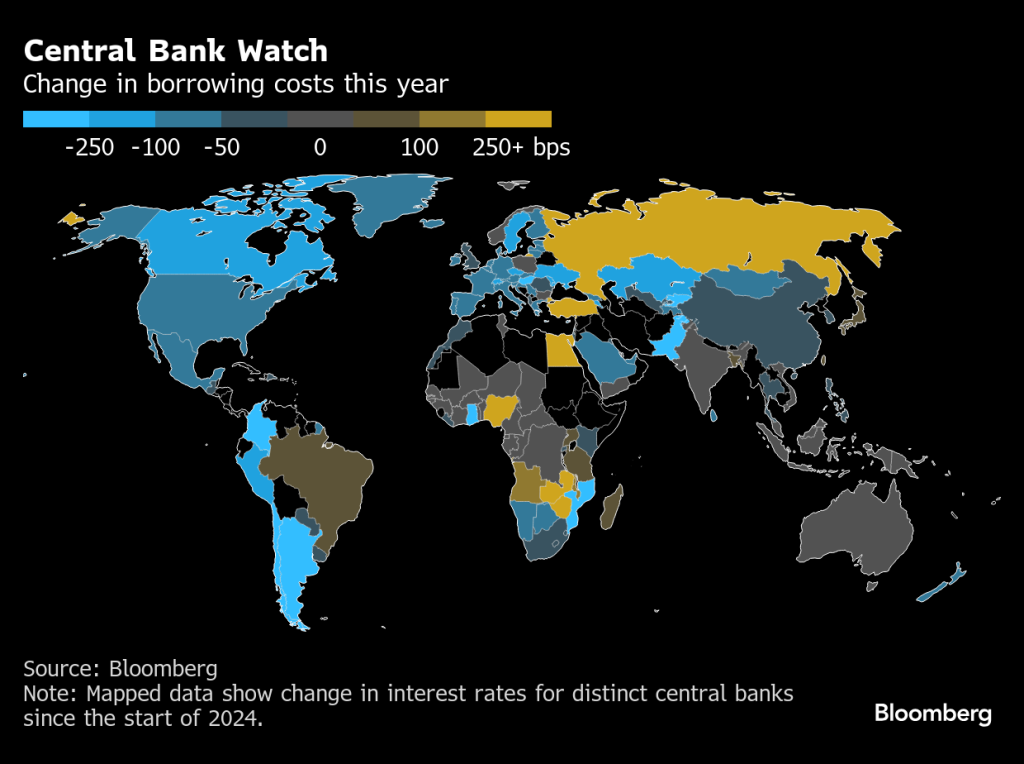

As the ECB navigates its monetary policy, it's essential to consider the broader implications of these rate reductions. Global economic conditions are complex, with varied responses from other central banks. For instance, the

is projected to engage in rate cuts as well, but at a slower pace compared to the ECB. This difference highlights how the ECB is positioning itself to tackle the unique challenges of the Eurozone, which include not just moderate inflation, but also a fragile recovery path.

Some economists predict that further rate cuts may be on the horizon, potentially reaching as low as 1.75% by mid-2025. If successful, this could align the Eurozone’s economic performance more closely with its global peers, making the region more competitive.

Conclusion

The ECB’s recent decision to lower interest rates is more than just a reactionary measure; it represents a calculated strategy aimed at fostering economic growth in turbulent times. By prioritizing growth over inflation control for now, the ECB is acknowledging the immediate needs of the Eurozone's economy. As we look ahead, the interplay of political factors, global economic trends, and monetary policy will undoubtedly shape the financial landscape of Europe. The coming years will test the ECB's commitment to its goals of stability and growth, and it will be interesting to see how these dynamic elements unfold.