Biden Administration’s New Rule Transforms Medical Debt Treatment

The Biden administration's new rule removes medical debt from credit reports, empowering millions with better financial opportunities and improved credit scores.

Key Points

- The Biden administration's rule removes unpaid medical debt from credit reports, benefiting approximately 15 million Americans by improving their credit scores.

- This change is expected to increase the approval rate of mortgages by around 22,000 annually, opening new financial opportunities for families.

- The rule also prevents debt collectors from leveraging medical debt to intimidate consumers, promoting greater financial fairness and transparency.

In a groundbreaking move, the Biden administration has introduced a rule that eliminates the inclusion of unpaid medical debt from consumer credit reports. This significant change, spearheaded by the

(CFPB), affects approximately 15 million Americans, allowing them newfound financial freedom and access to essential loans. As we delve further into this development, it’s crucial to understand how this decision will reshape the financial landscape for many families.

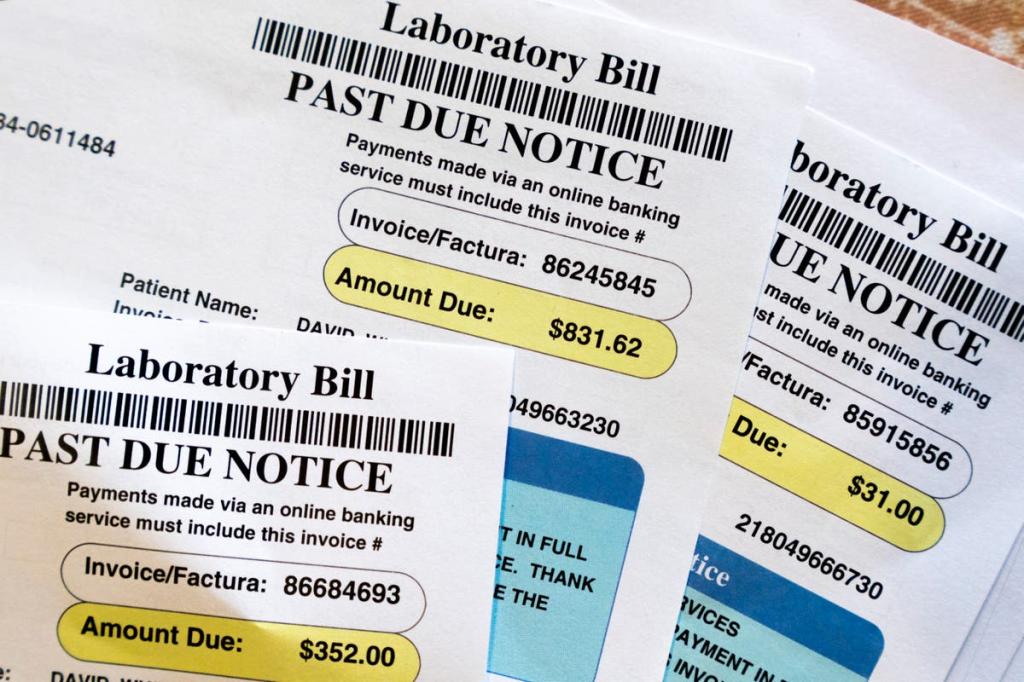

The Weight of Medical Debt

Medical debt has plagued millions of Americans, often acting as a barrier to securing loans for homes, cars, and businesses. The CFPB found that medical bills are a poor predictor of a person’s ability to repay other forms of debt. In fact, research showed that nearly 58% of collection entries on credit reports were related to medical debt. This statistic highlights that many individuals who are responsible with their finances could potentially have their dreams thwarted due to unexpected health crises.

The Positive Implications of the New Rule

The new rule is set to remove an estimated $49 billion in medical debt from credit reports, leading to an average increase of 20 points in credit scores for those affected. This boost may seem slight, but it could result in the approval of approximately 22,000 additional mortgages each year. Vice President

emphasized the transformational nature of this change, stating, “No one should be denied economic opportunity because they got sick or experienced a medical emergency”.

Addressing Consumer Rights

The CFPB's commitment to consumer rights extends beyond merely removing medical debt. The regulation also prevents debt collectors from using the credit reporting system to intimidate individuals into paying bills they may not even owe. This addresses a common problem where inaccurate billing leads to undue stress for consumers, particularly in moments of health-related crises.

The Broader Picture

This reform is part of a larger agenda aimed at alleviating the burdens of healthcare costs on American families. In addition to changing credit reporting policies, state and local governments have utilized federal pandemic relief funds to eliminate over $1 billion in medical debt for more than 700,000 individuals. Such initiatives can fundamentally shift the financial realities for many, especially in communities that are disproportionately affected by medical expenses.

The Road Ahead

While this new regulation has sparked excitement among advocates and consumers, it has also drawn criticism from various financial institutions. Arguments have been made that removing medical debt from credit considerations may increase lending risks, potentially leading to borrowers taking on more debt than they can handle. Nonetheless, the CFPB has stood firm on its position that the absence of medical data will enhance, not harm, responsible lending practices.

A Beacon of Hope for Many

As this rule takes effect in the coming months, it represents a significant policy change that prioritizes the financial wellness of Americans grappling with healthcare costs. The action is not merely a regulatory adjustment; it is a commitment to ensuring that medical emergencies do not dictate one’s financial future. For countless families, this shift will serve as a beacon of hope, fostering resilience and economic growth in an increasingly challenging world.

In summary, the decision to remove medical debt from credit reports marks a pivotal moment for consumers across the nation. By addressing the unique challenges posed by healthcare-related financial burdens, this rule not only helps millions gain access to necessary credit but also reinforces the notion that one’s health should never jeopardize their economic opportunities.